Who doesn’t want predictable recurring revenue?

It’s part of the appeal of SaaS for most business leaders and decision-makers. It’s all based on a simple tradeoff: you allocate a budget to product maintenance and upgrades, and in return, you secure a recurring source of income.

The challenge then becomes making that revenue predictable so you can make informed strategic decisions. Depending on your SaaS pricing strategy, that may come easier to you, or it might turn out to be incredibly difficult.

Today we’re going to walk through all the ins and outs to consider:

- SaaS Recurring Revenue Basics. We’ll start with the definition, move on to related metrics / KPIs, and review the benefits of securing a continuous revenue stream in SaaS.

- The 4 Pillars of Recurring Revenue. Next, we’ll delve into 4 elements that we believe can make or break the pricing model, plus advice on how to be smart about implementation starting from these pillars.

- Pricing Strategies and Examples. To effectively secure a future-proof model, you need an appropriate pricing strategy. Not all of them work for the purpose of reliable recurring income, so we’ll delve into the ones that do, with some examples for each.

What Is the Recurring Revenue Model in SaaS?

The recurring revenue model, part of the foundation of SaaS, represents a business and pricing approach centered around having a reliable source of periodic income, either monthly or annual, through the use of subscriptions and scheduled payments.

The strategy allows businesses to focus on fixing, polishing, and upgrading the software product to meet and exceed customer expectations and outcomes. This creates a predictable growth and revenue system, with data-enabled estimates that can accurately point out the trajectory of the business.

A recurring revenue model in SaaS is furthermore a very stable way to run a business, offering reliability to both the company itself and its customers – who end up receiving a product with support, maintenance, and upgrades already factored into the cost of goods sold.

MRR vs ARR

You can measure a SaaS’s success with the recurring revenue approach by looking at two key metrics:

- Monthly Recurring Revenue (MRR). An indicator of the monthly revenue stream. To find your MRR, determine your average returns per user per month (ARPU), then multiply that number by how many paying users you have. A more advanced Net MRR formula will help you factor in losses, but might take up more time to calculate since you have to determine your MRR from all reactivated, upgraded, downgraded, canceled, and new accounts. You can see all formulas mentioned a bit further down the article.

- Annual Recurring Revenue (ARR). An annual recurring revenue model is slightly more complex than MRR because it must always factor in the losses incurred over the given period. Sure, you can simply multiply your MRR by 12, but the result will be quite far from accurate, even if you use Net MRR. So, to reliably calculate ARR, make a sum of your SaaS revenue for the given year, adding all revenue from add-ons and extra features or upgrades, then subtract the revenue you’ve lost from users who’ve churned or lowered their subscription tier.

↪ What is a good MRR?

With MRR, the concrete dollar number depends on your type of business, your niche, your audience, how much customers are willing to spend, and so on. A better metric to use is MRR growth rate, which essentially shows how much your MRR goes up month-over-month (MoM).

A good MRR growth rate is anywhere between 10% and 20%, according to most SaaS companies we’ve seen. In the initial stages of your SaaS, however, a growth rate of over 15% MoM will ensure a steady and healthy outlook for your company.

To calculate your MRR growth rate, simply subtract the Net MRR of your current month from last month’s Net MRR, then divide the number by last month’s net MRR. The result should be a percentage, as shown in the formula below.

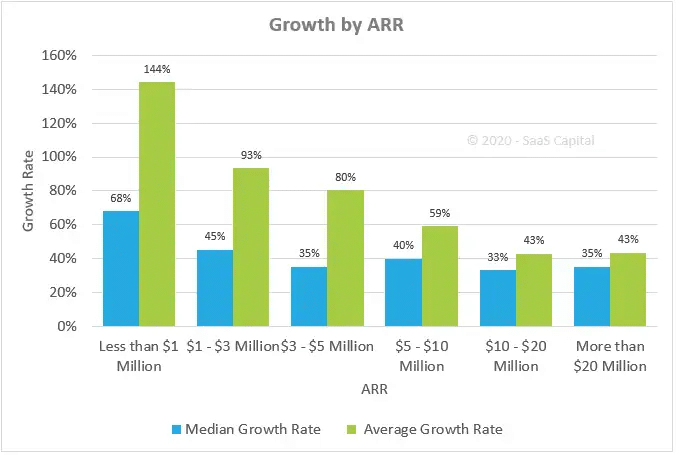

↪ What is a good ARR?

While ARR benchmarking is also not very reliable, it’s more frequent that we see a real number as a guideline compared to MRR. Usually, a good ARR is anywhere between $1M and $5M, particularly for an up-and-coming SaaS. But don’t rely on this too much, as it’s a lot smarter to focus on your product, your customers, and if you need metrics, go for MRR, CRC, LTV, and other more insightful metrics.

MRR and ARR Formulas

MRR = ARPU Number of Paying Users

Net MRR = MRR Gained – MRR Lost

where:

MRR Gained = New Users MRR + Reactivated Users MRR + Ugraded Users MRR

MRR Lost = Canccelled Users MRR + Downgraded MRR

MRR Growth Rate = (Current Month Net MRR – Last Month Net MRR)/Last Month Net MRR 100

ARR = (Annual Revenue from Users + Annual Revenue from Addons & Upgrades) -Annual Revenue Lost

Types of MRRs and How They Apply

- MRR from Upgraded Subscriptions and Add-ons. The struggle to obtain a steady income stream will always be a battle between profits and losses. Upgrade & Add-ons MRR, aka Expansion MRR, is one of the main success indicators for upsells, cross-sells, and any other form of additional revenue such as paid add-ons and extra features.

- MRR from New or Reactivated Subscriptions. I.e., the revenue generated from new accounts and customers who return and reactivate their subscriptions after previously churning. Reactivated MRR is often its own metric tracked separately to New MRR.

- MRR from Customer Renewals. Renewals are naturally a big thing for recurring revenue. Therefore tracking Renewal MRR is one of the ways in which CSMs and their teams track how successful they are at securing retention and obtaining renewals on a month-to-month basis.

On top of these, we have MRR loses, which usually come in two categories:

- MRR Losses from Cancellations, also known as Churn MRR, measures how much churned customers cost your month-over-month, providing great insights into the areas on which you need to focus.

- MRR Losses from Downgrades. Subscription downgrades are also a form of MRR loss, which should be tracked separately

Recurring Revenue Models + Examples

Recurring revenue models represent the concrete billing plans that cater best to a steady recurring income stream.

1. Flat Rate Billing

The simplest recurring revenue billing model, Flat Rate means all of your customer base gets billed at a set dollar value.

PRO: simple and predictable, great for projections.

CON: might be an obstacle to obtaining new subscribers.

Best for: simple SaaS products that don’t require multiple subscription plans.

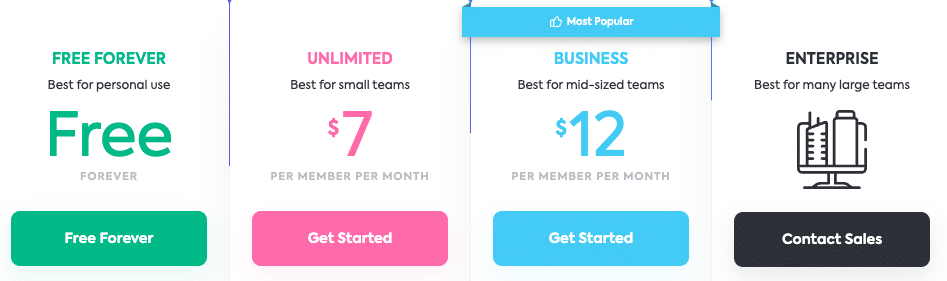

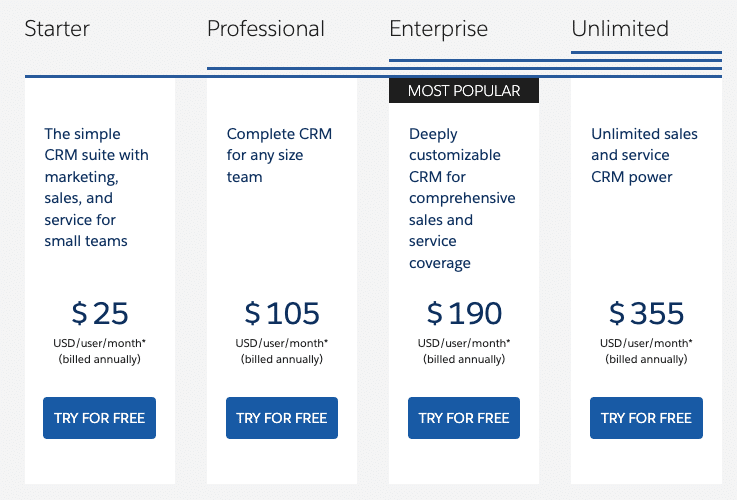

2. Tiered Billing

Tiered billing implies multiple plans available for customers to choose from based on their needs – each tailored to a specific audience segment.

PRO: makes your product accessible to a wider audience.

CON: too many tiers can confuse users and cause analysis paralysis.

Best for: complex SaaS platforms

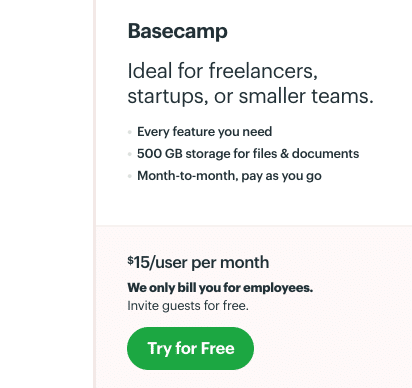

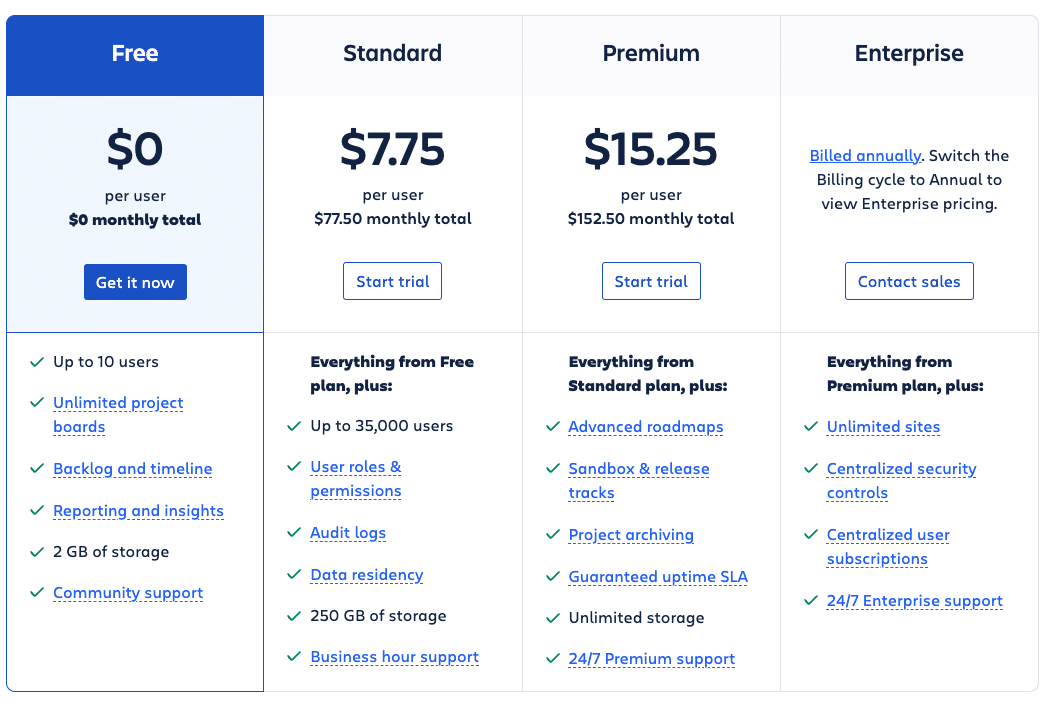

3. Per-user Billing

Per-user billing implies a single price point for each user account created by the customer. It may not be the best one for reliable recurring revenue, as individual users can come and go, but it still works fairly well if you manage to keep user churn in check.

PRO: Allows customers a lot of flexibility in terms of users and how much they want to pay.

CON: Not great for reliable recurring revenue as users may leave for reasons unrelated to you (and so you don’t have many avenues to save them).

Best for: collaboration and productivity tools where having the entire team onboarded is an advantage.

4. Per-feature Billing

Per-feature billing is, as the name implies, a model by which you bill customers for every extra feature, add-on, or upgrade they make to their subscriptions.

PRO: works well at scale because, if you manage to prove feature value to your customers, chances are slim that they’ll ever remove it unless the entire account churns.

CON: if customers don’t understand the value of the features they’re paying for, they will remove them, and therefore decrease your MRR, so extra effort must go to value realization.

Best for: SaaS platforms with extensive and highly specific feature lists

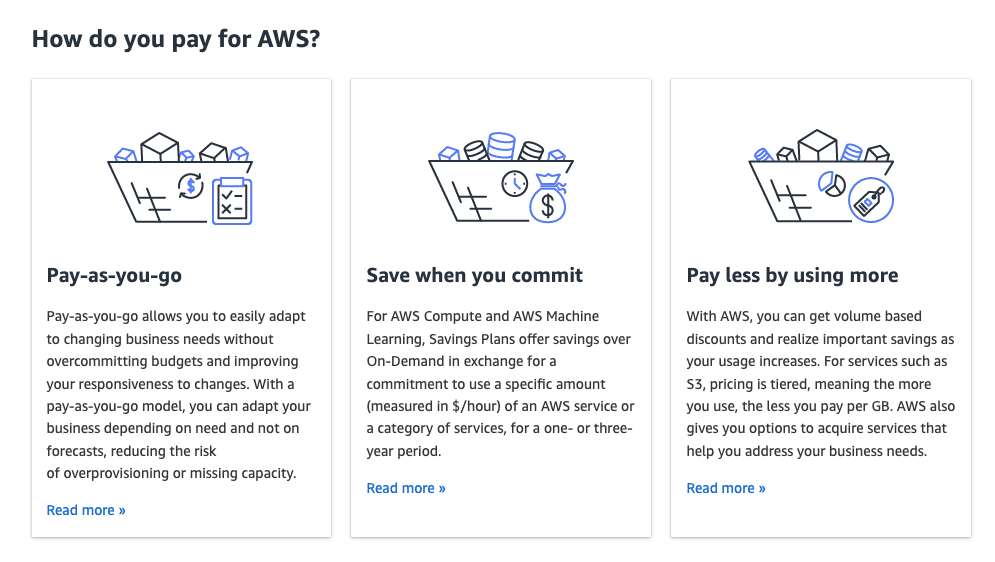

AWS has probably one of the best examples of per-feature billing, allowing customers to calculate the price of their subscription by adding and removing features in their pricing calculator.

5. Hybrid Billing

Hybrid billing models take a combined approach to pricing, allowing customers to add a limited number of users or level of usage before they are required to upgrade to a higher subscription plan.

PRO: works great for increasing revenue at scale without lowering MRR due to deactivated users

CON: can become a blocker for customer success as customers reach their subscription limit and cannot afford a higher plan

Best for: SaaS where the value delivered is complex and cannot be divided by the number of users customers add

6. Usage-based Billing

Through this classic recurring revenue model, customers get billed for exactly how much they use the product.

PRO: attracts new customers who might be unsure whether they’ll use the software enough to justify a subscription

CON: not a great model for a steady recurring revenue flow as usage may vary wildly and defy any of your projections.

Best for: SaaS products that have the option of tracking usage across the entire customer base at scale

7. Freemium

A popular model among many SaaS today, freemium implies offering users a free premium product, and then billing those users only for premium upgrades, add-ons, and features.

PRO: greatly increases user acquisition by lowering the barrier of entry and the commitment level needed to use the product

CON: more difficult to generate ROI, requires concentrated efforts and customer marketing tactics

Best for: SaaS with a low servicing cost per user and, optionally, B2C SaaS with the potential to go viral

4 Best Pricing Strategies for Recurring Revenue + Examples

Pricing strategies, in loose terms, represent the guiding principles that determine the price of a product or service.

There are plenty of pricing strategies to pick from, but not all of them are ideal if you want a predictable and reliable revenue stream for your SaaS. In what follows, I’ll run you through what I believe to be the best ones:

1. Cost Plus Pricing. Likely the simplest pricing strategy, Cost Plus Pricing is a sum of CAC, COGS, and your desired profit margin. Cost Plus does not consider the market, the target audience, or any related trends.

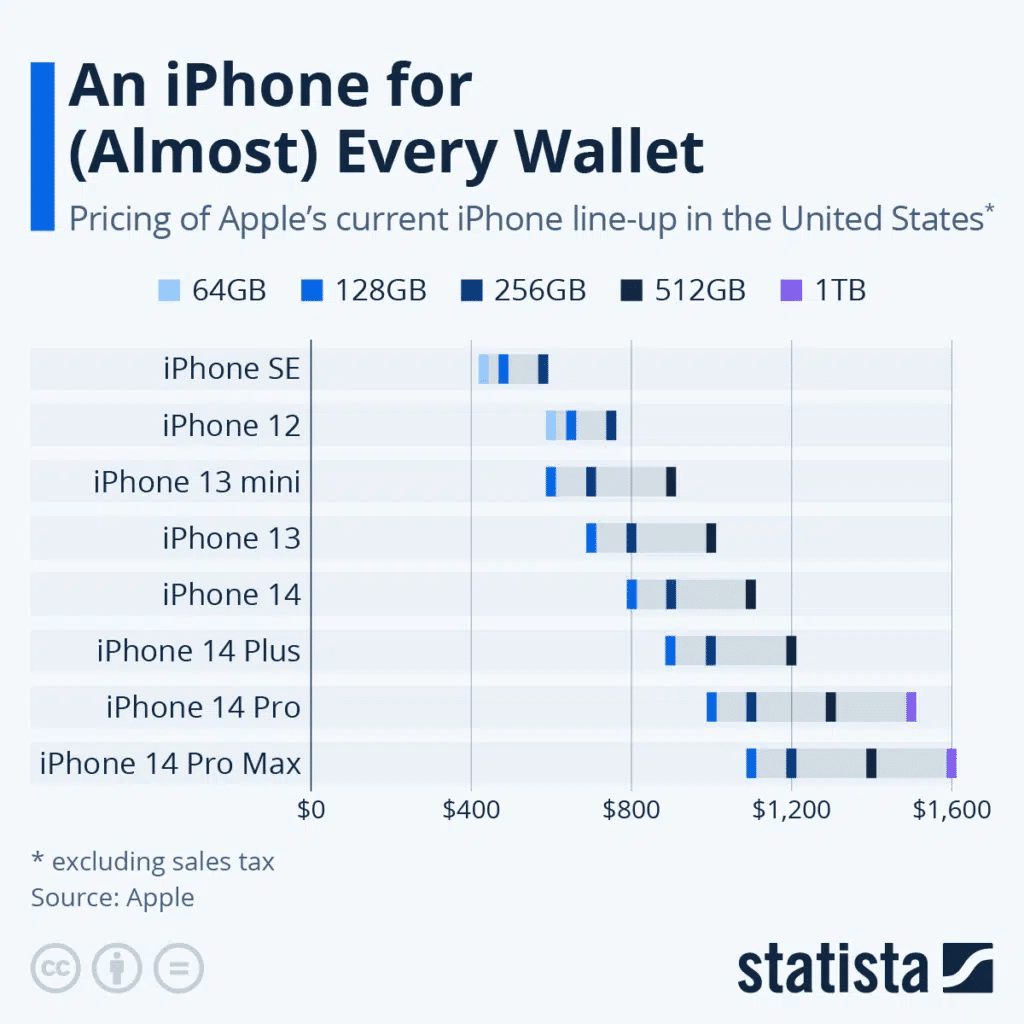

2. Skim Pricing. A high initial cost for your product, then slowly lowering the price as you launch newer, more expensive products. It’s a very devious strategy, but it also works, as evidenced by Apple, which uses skim pricing for most of its products.

3. Prestige Pricing. A luxury pricing strategy, prestige pricing typically means you’re setting a single, rounded price for your main product, banking on the feeling of “prestige” that your customers feel once they receive it.

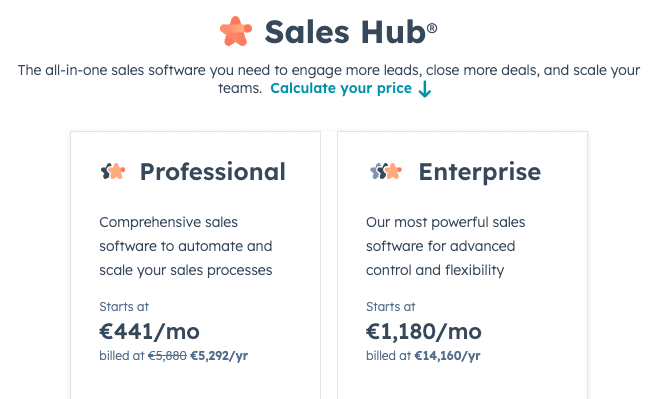

A great example of prestige pricing in SaaS is Hubspot’s Sales Hub, starting at €5,292/yr, plus a one-time onboarding fee of €735.

4. Value-based Pricing. At the opposite end to Cost Plus Pricing, we’ve got Value-based Pricing. Instead of completely disregarding the target audience and market, Value-based pricing starts from the purported value the products and services provide the customers, and then adjusts the price based on market trends.

For a more in-depth analysis from a pricing standpoint, check out our full review of all SaaS pricing strategies and models, complete with a downloadable cheat sheet.

Benefits of the Recurring Revenue Model in SaaS

A recurring revenue model can empower SaaS companies to jump over the inevitable hurdles in the path of a startup. Even less predictable recurring revenue models are still overall more sustainable than one-time revenue models.

Here are just a handful of benefits that come to mind:

1. Enables you to optimize acquisitions and onboarding

While minimizing budget concerns, recurring revenue models allow for a greater focus on the initial stages of your customers’ journeys.

Why?

Many investors and C-levels measure SaaS performance by looking at the CAC:LTV ratio, aka the relationship between the cost of customer acquisition (CAC) and their lifetime value (LTV or CLTV). Naturally, through recurring revenue models, LTV goes up, so the ratio itself lowers, unlocking a higher budget for acquisition.

Conversely, a good SaaS customer onboarding will drive customers towards their goals and ensure loyalty long term. So essentially, both CAC and onboarding costs now become par for the course.

2. Improves customer stickiness, retention, and loyalty

One of the simplest ways recurring revenue models help SaaS is by driving customer stickiness. In essence, since customers are paying for a subscription, they’ll make use of the product or services to the fullest extent (provided you’ve got good onboarding).

Once customers integrate your product or services into their workflows, they’ll have a hard time migrating to another product. The cost of switching providers might never be justifiable, especially for customers on a budget.

Your only concern at that point should be how to make their experience friendlier and more rewarding, and the possibility of customer churn as unpalatable as possible.

3. Offsets maintenance and support costs by including them in COGS

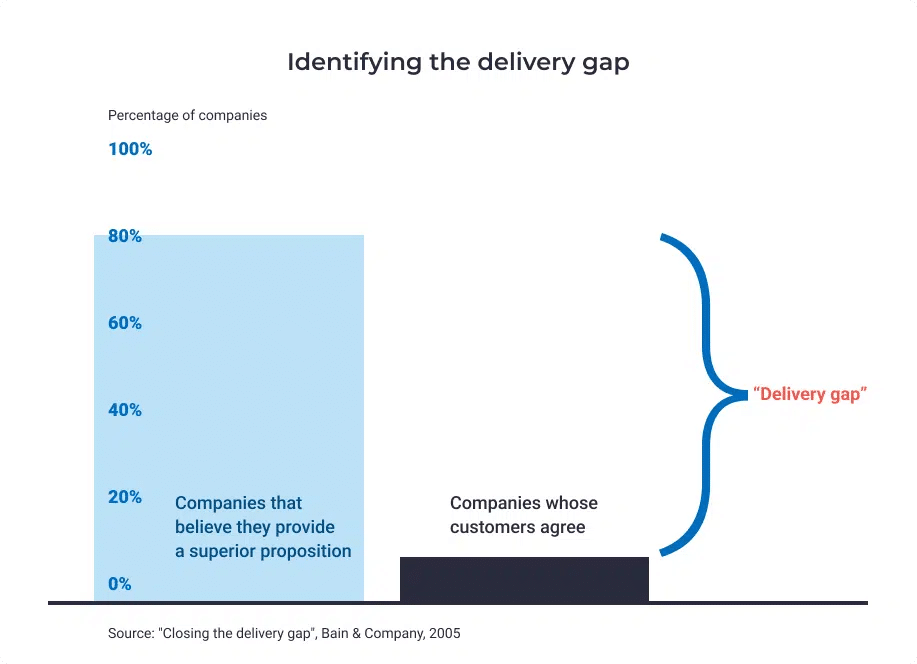

When planning for a recurring revenue model, business leaders must consider the cost of product maintenance and customer support. If the product doesn’t work long-term, at scale, and doesn’t satisfy customer expectations, delivery gaps appear.

Delivery gaps come up when companies’ perceptions of their products and services don’t line up with their customers’ perceptions of the same. Furthermore, the gap model for customer service also defines the customer gap, i.e., the difference between customers’ perceptions and their expectations (since customers might want a lot more than you’re able to offer).

A recurring revenue model allows you to factor maintenance and support into the cost of goods sold (COGS), thereby proactively preventing gaps in your customer service.

4. Allows for thought-out and strategic short-to-long-term business plans

Last but not least, recurring revenue models allow for better, data-led business plans, both short-term and long-term. And the importance of a business plan cannot be overstated; it acts as a roadmap, guiding the business towards its objectives and goals. A steady, predictable cash flow is much easier to manage than one-time cash injections whenever you launch a new product. That means everything, from EBRs to quarterly budget plans, becomes much less of a hassle.

How to Successfully Implement a Recurring Revenue Model in SaaS

Now that the value of recurring revenue models is clear, we can delve into implementation. To start, let’s look at the 4 pillars that help your model achieve consistent returns:

The 4 Pillars of a Consistent SaaS Recurring Revenue Model

Having a recurring revenue SaaS model does not equal success. You’ll also need:

- A good pricing model and strategy paired with a reliable billing solution. Not all SaaS pricing strategies work well for the recurring revenue model. I go through the best ones further down the article. Beyond that, you’ll also need a good billing solution with account updaters, direct debit payments, and dunning emails.

- A thought-out sales cycle that includes upsells and cross-sells. The sales process doesn’t end once you’ve secured a new account. Customer success and sales should work together to come up with an appropriate upsell and cross-sell strategy to increase MRR.

- A dedicated customer retention process that works at scale. Customer retention looks different from company to company. The most important thing is that you have such a process within your organization. Typically, retention SOPs include:

– Account monitoring and health scoring.

– A process for proactive customer engagement.

– A voice of the customer initiative.

– A customer success platform enabling CSMs to implement all of the above. - A well-equipped and experienced customer success team. To turn your recurring revenue into a predictable model for growth, an experienced CS person or team is necessary. If all goes well, they’ll be your ally throughout the implementation process and help you towards that coveted, stable cash flow.

Steps to Intelligently Adopt a Recurring Revenue Model

1. Apply Your Chosen Pricing Strategy and Model

Now that you know your chosen pricing strategy, the natural next step is to figure out the exact price points of your products and services. Simply follow your strategy to calculate your ideal pricing and then apply it together with your CFO.

2. Setup Your Sign-up Flow Correctly

There are many common pitfalls to recurring revenue success, and one of the biggest ones is the sign-up flow. If your leads get lost in the process of signing up, you’ll overspend on your marketing while your ROI will be very far from your predictions. So ensure you have a proper, intuitive sign-up flow and test it repeatedly on multiple devices to ensure it works.

Pro Tip

Remember to optimize your website’s mobile sign-up flow as well as the desktop one. Many SaaS businesses only focus on the latter, despite the internet’s move to mobile-first design and indexing all the way back in 2016.

3. Optimize Initial Customer Journey Stages

Once the sign-up flow is done, it’s time to think about all the other stages of the initial customer journey:

- Discovery and consideration. True recurring revenue strategies begin with marketing – so ensure your messaging works well and is aligned with your company’s offer (to prevent bad fit customers). In the same vein, make sure your Sales team is selling product truth.

- Acquisition. A higher budget for acquisitions will permit Sales and Customer Success to work together and organize more in-depth demos with potential customers and show them exactly what the value of your product and services is and how you can apply your SaaS to solve their pain points.

- Onboarding and implementation. If you want your recurring revenue model to be future-proof and scalable, you need to optimize both onboarding and implementation. That way, you ensure customers correctly set up the product and achieve their desired outcomes in their business relationship with you and thus feel inclined to continue patronizing you. If your SaaS onboarding process doesn’t work, then the money put into marketing and sales will be at least partly wasted.

4. Work on Growing Your MRR

Optimizing the marketing, acquisition, onboarding, and implementation stages is not a one-and-done process. You need to continuously monitor and improve your practices. That also includes upgrading your product, launching new features, add-ons, and improving your upsell / cross-sell playbook. All of these combined should see your MRR slowly but surely go up month-over-month.

Most Common Challenges to Consistency in Your Recurring Revenue

- Custom Features or Services. If customers consistently want custom services or features on top of their monthly plan, you won’t be able to accurately plan around your recurring revenue model due to lack of predictability. However, that doesn’t really harm your ROI and it’s more of an inconvenience than anything else.

- New Features or Services. Launching new features means you’ll increase your spend on Product without knowing if your customers will like, adopt, or pay for those features. This can have unexpected consequences, so you should anticipate some turbulence.

- Consistent Delivery. For recurring revenue to work, the product needs to be delivered consistently and at scale, so customer support, product maintenance, and QA costs will go up.

Ready to Roll?

Once you have all the details of your recurring revenue strategy in place, all that’s left is to get to work implementing and optimizing it at scale for your entire customer base.

SaaS solutions are booming – the entire subscription economy is set to reach $1.5 trillion by 2025, according to recent market analytics. In this overcrowded market, your product will need to stand out to cash in.