For your next quarterly meeting, get ready to impress with one metric I’m sure most of you’ve heard of, but few have actually used.

I’m talking, of course, about the CAC Payback Period. And while it sounds unnecessarily technical, it’s actually a very simple metric that can give you and your stakeholders some really powerful insights into your entire SaaS business strategy and how to make it more efficient.

Why? With CAC Payback Period you get to predict the value of a customer to your business without having to look at LTV:CAC, which can be very misleading and disconnected from reality.

In what follows, I’ll explore:

- What CAC Payback Period really means – what it’s good for, and how it matches up against LTV:CAC.

- How to use CAC Payback in your SaaS – including the formula to calculate it

- Tactics you can employ to reduce your CAC Payback Period – including through PLG (product-led growth)

- A breakdown of common mistakes, mishaps, and poor management decisions in using CAC Payback – including an opinion from highly experienced product professional.

In a business landscape where 71% of CEOs want to revamp their customer journeys (CX Trends 2023), you can bring the winning insights to the table by simply looking at CAC Payback 😉Now, let’s dive in!

What Is CAC Payback Period?

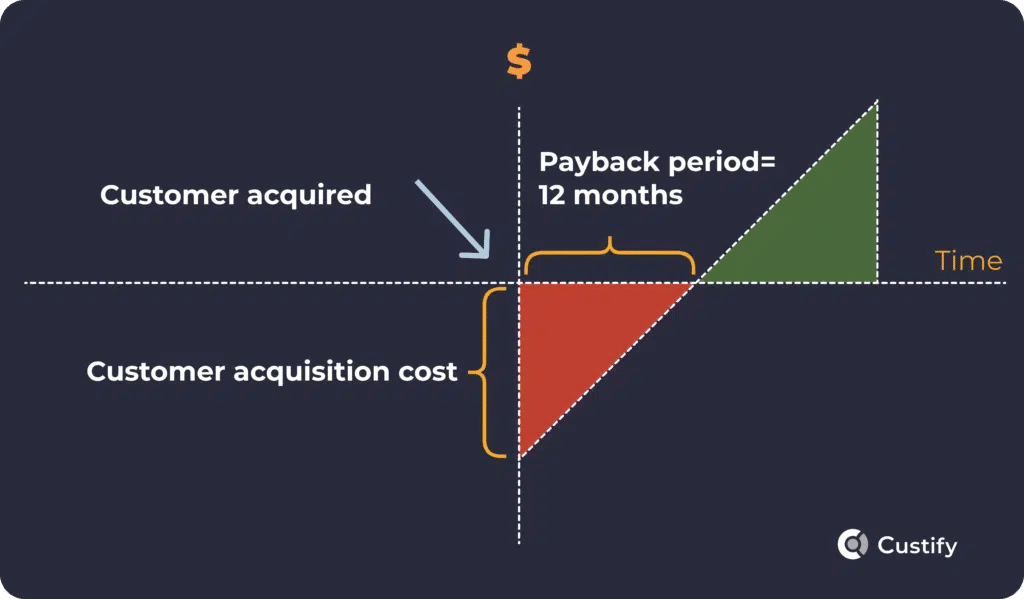

CAC Payback Period, also known simply as CAC Payback, is a business metric that shows how long it takes a business to make back the cost of customer acquisition (CAC). As a rule of thumb, the lower your period is, the more profitable your company becomes.

CAC Payback is typically calculated as an average for the entire customer base or a specific customer segment. However, it can be measured for a specific customer or group of customers.

Once you have your payback period, you can use it to set an objective for your CS team to prevent any and all churn during this period – as losing accounts before they turn a profit for you is a surefire way of sinking your business.

We’ve added the formula further down where we show how you can use CAC Payback in your SaaS.

Why Is CAC Payback Period Important?

CAC Payback can give businesses a clearer picture of their performance goals – one of the best things a metric can do in SaaS. Here’s a full rundown of the benefits, followed by some particularities for SaaS companies:

- Assigns a concrete number to profitability, helping set overall business goals and determine what success means for the entire organization.

- Allows you to see whether you’re overspending overall on acquisitions and on each individual account.

- Lets you see how big of a problem customer churn is. Looking at a low churn rate, you might think you’re doing well, but if your customers churn during your payback period, you might soon run out of runway.

- Helps highlight additional CAC costs that you may have not factored into your calculations. As such, it helps you reach a more realistic CAC, optimizing all related metrics.

For SaaS businesses, CAC payback:

- Generates more realistic estimates for COGS (cost of goods sold), allowing you to rethink your SaaS pricing strategy and model.

- Provides a very attractive metric for both leadership and investors, allowing them to know exactly when customers become profitable so they understand when to expect their investments back. This sort of fiscal predictability can be a lifesaver for a SaaS in its early stages.

CAC Payback Period vs LTV:CAC Ratio

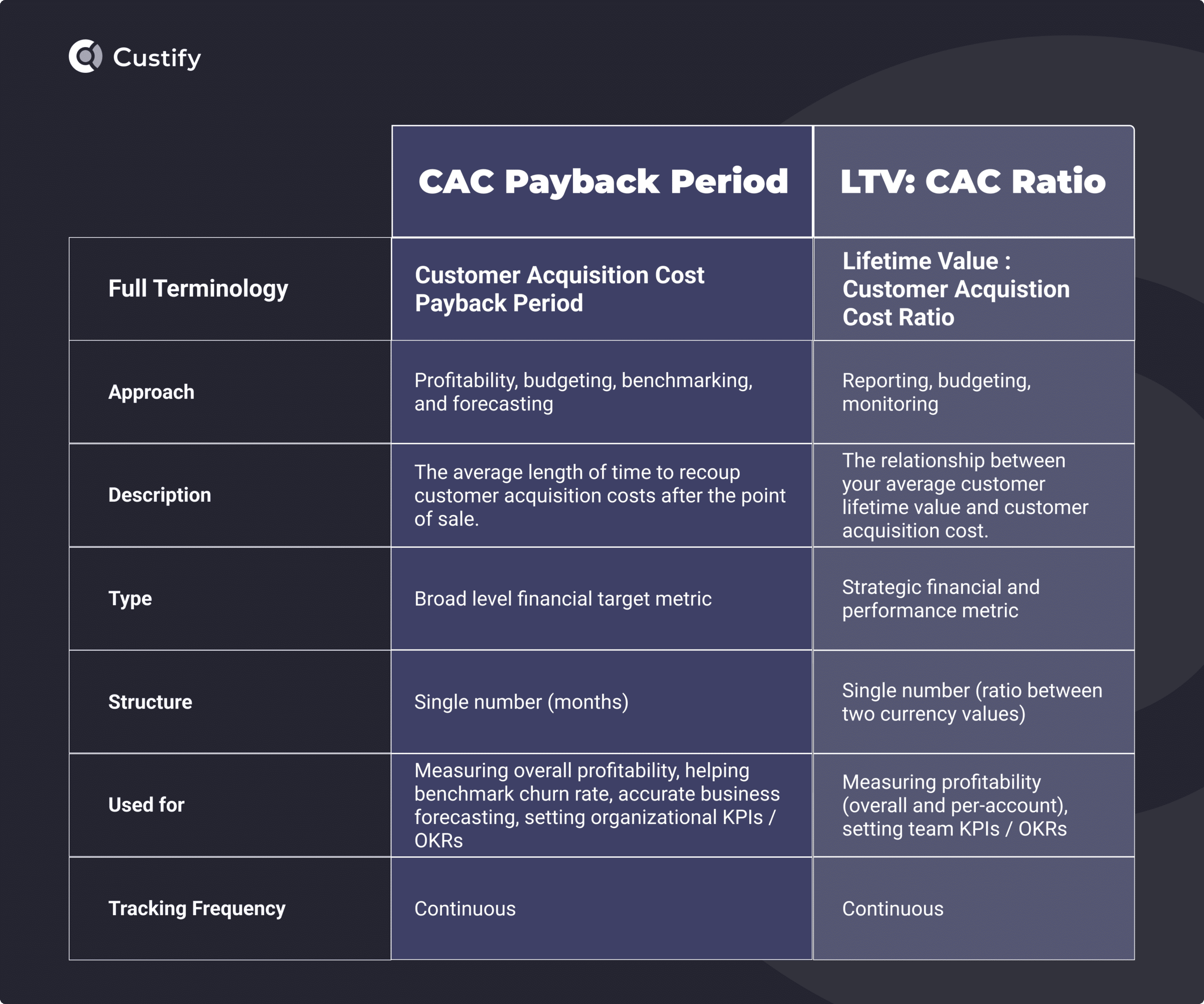

CAC Payback is often measured together with LTV:CAC to indicate the overall profitability of a business. However, between the two, LTV:CAC is far more popular, being included in most financial reports and hailed by many as the most important metric in a SaaS business. However, it can be very misleading if tracked without looking at CAC Payback. Why? Let’s zoom in a bit:

Assuming you have a stellar LTV:CAC ratio (say 3:1 or higher), you might be ready to rest easy and look at your ROI pouring in. But if that ROI takes 28 months to get back to you, you might run out of funding long before that. This is why CAC Payback tracking is vital, and I would say one of the most important ways to gauge SaaS solvency.

Let’s look at the two side by side for a moment:

↪ Which one is the better metric?

As seen in the table above, while both metrics are extremely useful, CAC payback has more overall uses and and can provide unique insights to inform business forecasting decisions far better than LTV:CAC. Ultimately, CAC Payback Period is more useful to measure consistently, but that doesn’t mean you shouldn’t track LTV:CAC.

↪ Can you use both? Do you need both?

The best approach is to track both metrics continuously and review them according to your preferred reporting frequency.

What Is a Good CAC Payback Period?

There are a few SaaS standards for what a good payback period means:

- For Seed Funding, you should aim for a payback period of 15 months or less, preferably less.

- For Series A Funding, a CAC payback of 21 months or less is ideal.

- For Series B Funding, industry benchmarks place CAC Payback at 17 months.

- For Series C Funding, you can afford a payback period of up to 28 months, though that’s not necessarily ideal for many businesses.

- Once you go past series C and onto Series D, the average CAC payback period lowers back down to 21 months.

Of course, these two numbers are very arbitrary and will vary greatly based on your SaaS pricing model and strategy, industry, market, target audience, product, services, company size, and many other factors.

One such factor we should zoom in on is the economic landscape within your industry during for your current fiscal year. To put it simply, here’s an example:

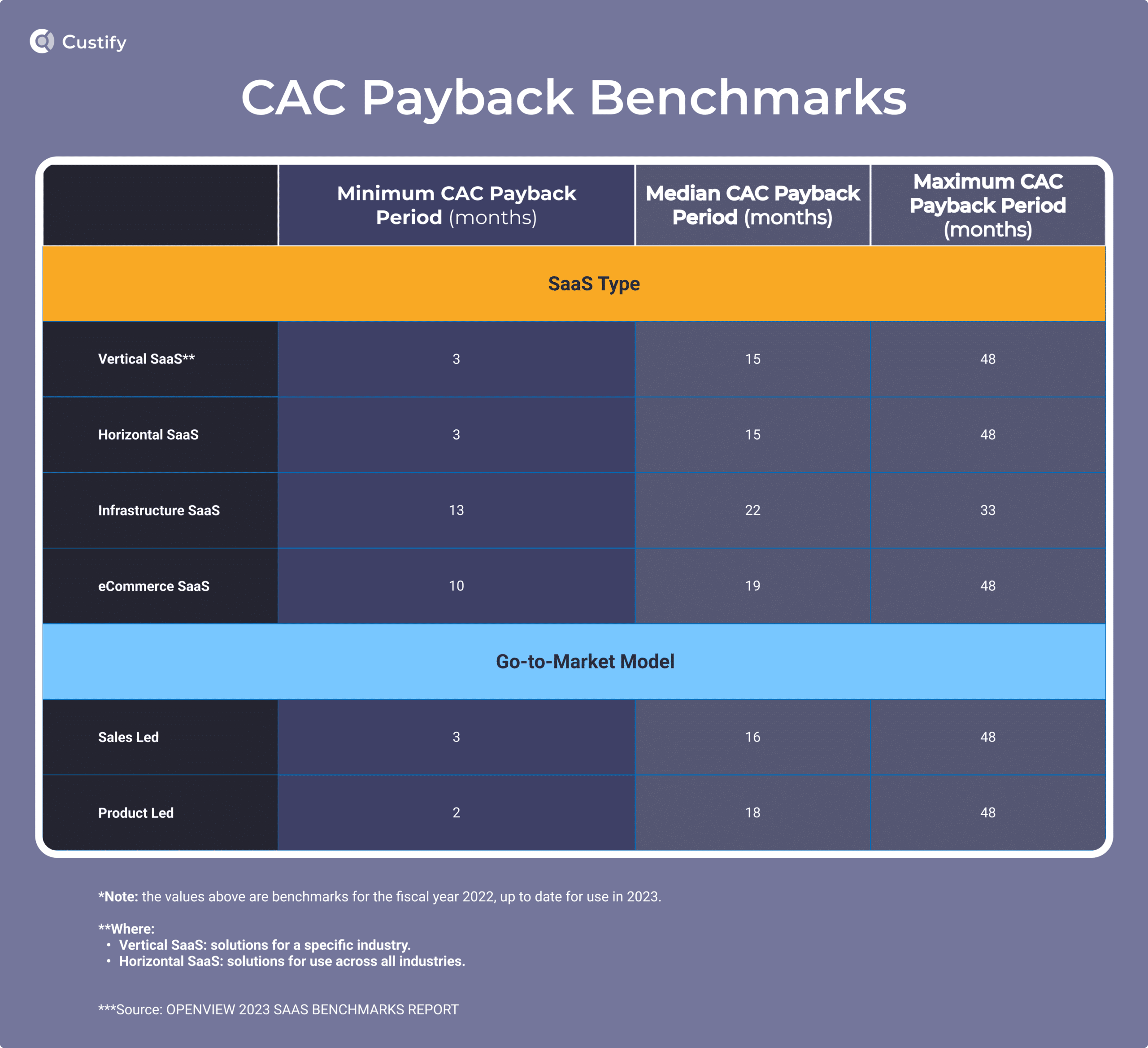

↪ According to the 2023 SaaS Benchmarks Report, the average CAC Payback Period for the 2022 fiscal year was 17 months. So if you’re measuring the same metric for a SaaS company in 2023, you should aim for the same number or lower, based mostly on which round of funding you’re on.

The same report can help us review CAC Payback by SaaS solution type and GTM model:

How to Use CAC Payback Period in Your SaaS

The first step to using CAC Payback is to learn how to calculate it. Here are the most common ways to do it:

How to Calculate CAC Payback Period?

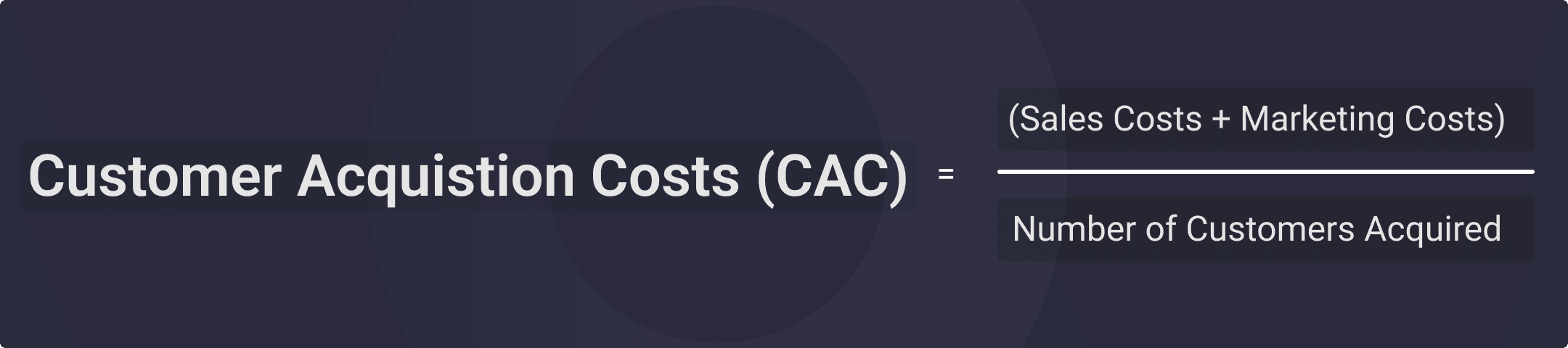

First, let’s remind ourselves of the formula for Customer Acquisition Cost:

Remember, however, that your CAC might look different than other SaaS:

- Product-led businesses often consider R&D (research & development) a part of Acquisitions. If that’s the case for you, make sure to includ it in your CAC formula next to marketing and sales costs.

- Speaking of sales and marketing, they might be handling upsells and customer marketing tactics, in which case you have to determine the percentage of their costs used solely for acquisition and use that number to calculate your CAC more precisely.

- Others might include other business areas into CAC – so make sure you’re not omitting anything important.

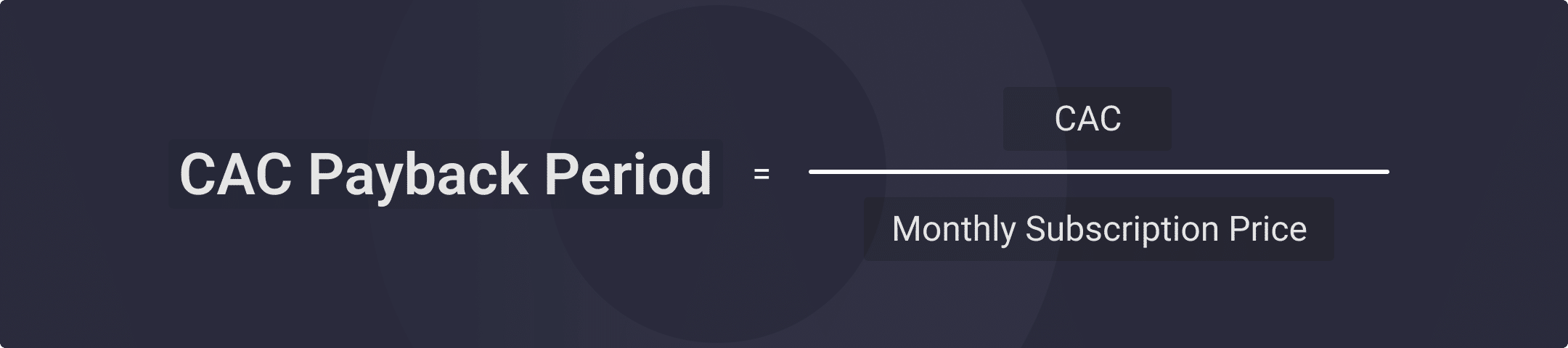

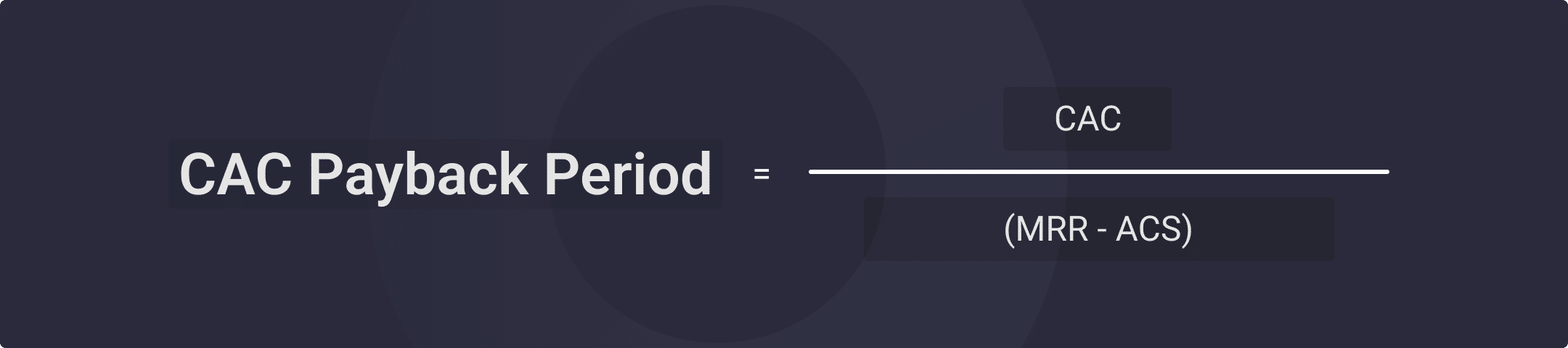

Moving on, there are several formulas to consider when calculating CAC Payback. I’ll go through them one by one, starting with the simplest one:

This is an oversimplified version, yet still very common. You can use it on the fly to estimate the payback period for a specific account. However, for actual forecasting and reporting needs, go for one of the more advanced formulas:

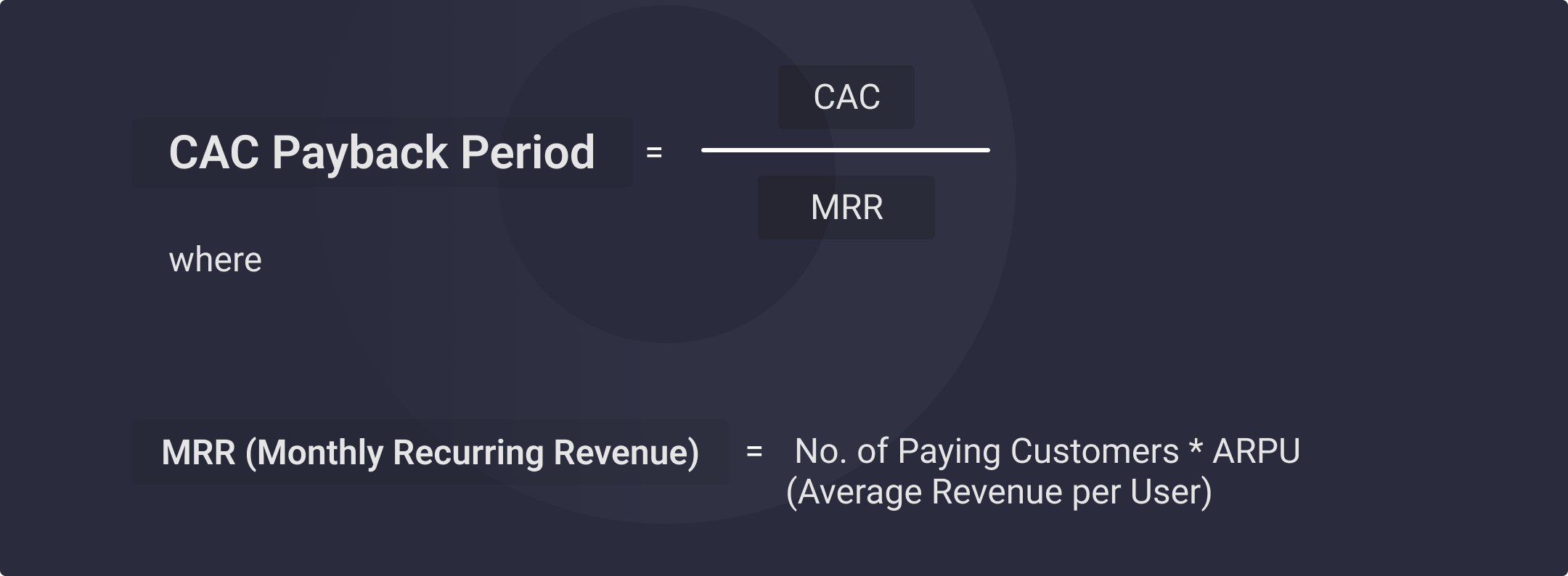

This version represents the standard way of calculating payback period. But we can go deeper:

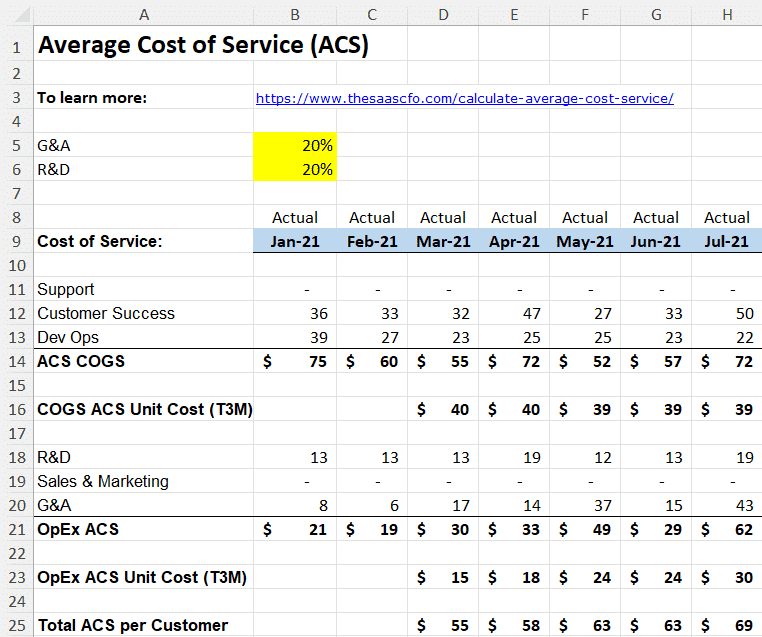

ACS in the formula above represents the Average Costs of Servicing an average customer. Calculating ACS will vary significantly based on your business, but it will always include both the Cost of Goods Sold (COGS) and all your Operational Expenses (OpEx).

Here is an example of calculating ACS from Ben Murray:

For more info on this, you can check out Ben’s article on ACS.

For your calculations, you’ll want to reach the “Total ACS per Customer.” Alternatively, Ben Murray also suggests you replace ACS with MRR * Recurring Gross Margin Percentage, if you have better access to those metrics.

How to Use CAC Payback Period

Once you’ve calculated your CAC Payback, your best ways to use it involve:

- Adding it to your recurring reporting schedule. Be it monthly or quarterly, you need to track CAC Payback as well as LTV:CAC to have an adequate picture of your financial safety net as a business.

- Using a customer success platform with a powerful reporting dashboard, paired with data governance and hygiene best practices to adequately monitor relevant metrics moving forward.

- Partnering with all CAC Payback stakeholders (marketing, sales, financial, customer success, product, and the C-level) to come up with a scalable strategy for lowering the payback period (start with some of the tactics below).

- Apply the tactics you come up with in a data-led way with full business-goal cross-departmental alignment, i.e. keep an eye on the data, inform stakeholders, and make sure everyone is aware of the desired business outcomes.

- Continue to monitor both LTV:CAC and CAC Payback moving forward. If something’s not working, pivot to a different tactic or a combination of tactics.

How to Reduce CAC Payback Period

1. Monitor and Work to Lower Customer Churn Continuously

As previously stated, customer churn can turn into an alarming issue when put next to CAC Payback Period. There are two simple reasons for this:

- Customers who churn within the payback period. First off, the obvious: if a customer leaves before you’re able to recoup the cost of acquiring them, you’re running at a loss. Not a good way to do business. So make sure you’re keeping customers for at least as long as your payback period.

- The compounding costs of customer churn. Now let’s assume you keep having the issue above. It’s a particularly bad sign, and here’s why: when a customer leaves during the payback period, there are leftover costs from acquiring them that will delay you breaking even. If this continues to happen, those costs will compound to the point where your CAC Payback Period will become unsustainable.

To counteract this, consider some powerful churn reduction tactics:

- Ensure customer-fit. When there’s a disconnect between the product and what Sales and Marketing are selling, you often get bad-fit customers, i.e. customers who don’t really fit your business model and therefore may struggle to find the value of your product. Prevent this by ensuring your acquisitions departments use the correct verbiage when selling your product.

- Optimize onboarding. For good-fit customers, your main goal should be to turn onboarding into a true driver of customer loyalty and revenue. CSMs can hold high-touch meetings with newly acquired customers to walk them through the product and secure their setup in a way that aligns with their stated objectives in their business relationship with you. Or you can simply use product tours to guide your hundreds or thousands of low-touch accounts through product setup and use.

- Improve the product. You might think I’m oversimplifying but product improvements should 100% be part of your SaaS process. Learn to prioritize customer needs by impact and urgency and create a clear-cut process from feature requests to product updates.

- Improve your support. Customer support can be a big reason behind both customer loyalty and churn, depending on your support quality and expediency. So make sure your support team is adequately staffed and equipped for reactive support, and then add proactive engagement through your CS team to lower the support load and improve CX.

- Combat involuntary churn. Involuntary churn can be a silent killer in your SaaS. To fight it, implement automatic account updaters to keep payment info up to date and dunning emails to notify customers about their subscription status.

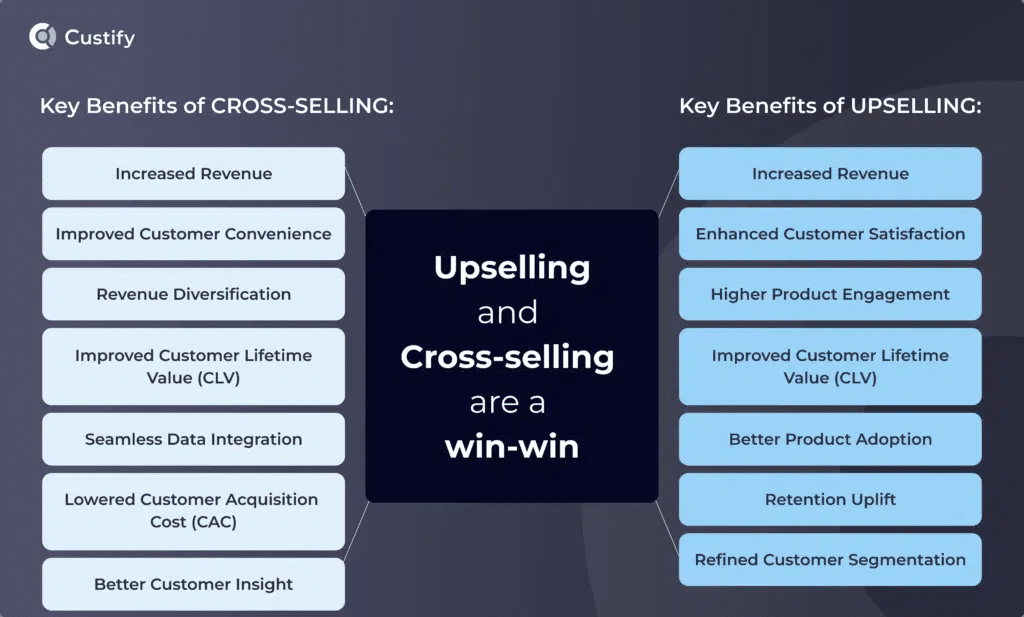

2. Find Smarter and More Effective Upsell Tactics

Successful upsells and cross-sells can effectively lower your payback period, particularly if you’re working in a scalable manner by establishing tactics and processes that will continue to work for other customers.

Here are some ideas you can try right now:

- Work with customer segments and buyer personas. Once you separate your customers into distinct segments with specific needs, it’s easy to create upsell scripts and playbooks to help you identify opportunities in an automated way for each segment.

- Prioritize upsells based on customer feedback scores. If a particular customer loves your product and has a high feedback score, upselling them will prove much easier. Do this at scale for a winning recipe.

- Follow your most important accounts. Keep up with their social presence, industry trends, and account dashboards. From there, it’s just a short walk to successfully upgrading them ot a higher subscription.

- Be smart about reach-out frequency, usefulness, channel, and timing:

– Frequency. Reach out on a sensible recurring schedule that doesn’t turn into spam.

– Usefulness. Make sure you’re always adding value, even if the customer decides not to upgrade, pick the correct channel for your outreach, and

– Channel. Pick the right channel – does your customer reach out via WhatsApp? Use that to reach out. Additionally, you can add a note for everyone in your business to do the same.

– Timing. Find the right timeslot for reaching out. Your customer might be in another timezone, so you want to make sure you’re not messaging them at 5AM.

Learn more in our Guide to Cross-sells and Upsells.

3. Prioritize Higher Value Customer Segments

Continuing the idea of customer segmentation above, you can go even further and prioritize high-value customers throughout your customer success efforts. Doing this not only lowers the payback period, it helps you make up for any customers who churn during that period.

Find a balanced workflow that allows you to:

- Spend more time with them during onboarding.

- Ensure their setup and implementation is completed correctly.

- Facilitate their integrations in a timely manner.

- Align on their goals and helping them throughout the process to reach them.

4. Market and Sell Your Products on Better Channels for CAC Payback

Improving your payback period is as much on Sales and Marketing as it is on CS and Support. So you should always be ready to cut or optimize your marketing channels. Here are some examples of what you can do:

- Eliminate routine channels. Sometimes marketing teams fall into a routine of managing channels that don’t necessarily bring in any meaningful ROI – such as X or Facebook. You should look at your Analytics and learn what to keep and what to cut.

- Cut channels prone to poor customer-fit. Look at payback period and LTV per marketing channel. If any channel is underperforming – say Facebook is driving in casual users prone to churning during the payback period – you should cut that channel.

- Increase activity on top-performing channels. S&M can redirect the budget and hours spent on cut channels towards those that bring in more consistent results.

- Diversify and research new channels. Provided you have the budget, your marketing team should test and add channels in an effort to expand your reach.

5. Change Your Pricing Model for a Lower Payback Period

Your pricing strategy might be the same since you launched. More often than not, we see SaaS who stick to their legacy pricing system out of an overabundance of caution and not wanting to upset their customer base. But changing your pricing model or strategy can be good both for you and your customers.

Here are a few ways you can make sure of that:

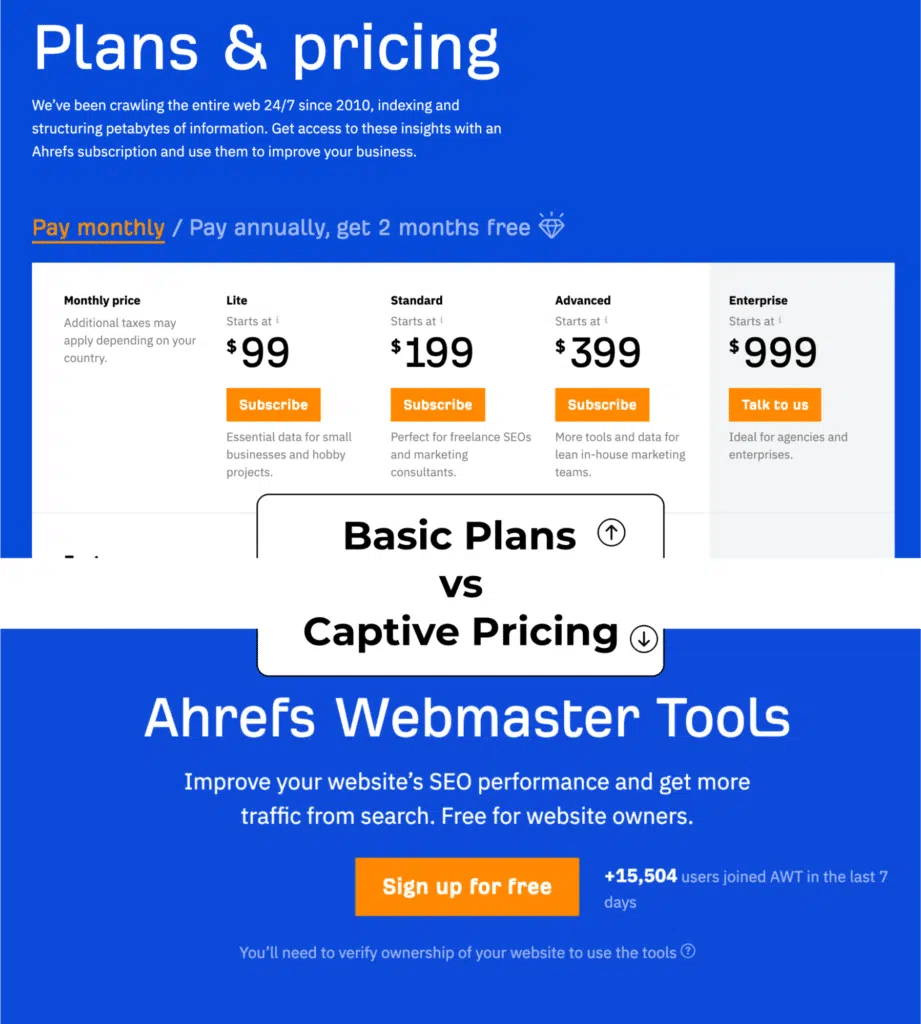

- Switch to annual pricing. If your current payback period is at most 12 months, switching to an annual pricing model will ensure you’re effectively recouping your CAC as soon as customers subscribe. If the payback period is 10 monts, you can even offer significant discounts like Ahrefs does in the example below.

- Opt for free trial pricing. Building on the annual strategy, you can even opt for a 1 month free option to incentivize customers to try out your product, then charge them for a whole year and make back more than you spent on their entire trial period (in theory, of course, in reality there might unforeseen costs).

- Try captive pricing. Captive pricing means offering a limited, free, but still useful version of your product to users for an unlimited time. Once you have this on offer, all you need to do is convince users of the value of subscribing, where you can once again offer a yearly subscription.

- Try per-user pricing. Some products become more valuable the more users a customer adds. That means you can essentially set a price point per user and incentivize customers to add more users by highlighting productivity and collaboration advantages. Your number of users will grow exponentially, while your payback period will decrease over time as a result. It’s a win-win!

Example of Captive pricing from Ahrefs. Read more about this and other strategies in our Pricing Cheat Sheet.

6. Invest in a Product-Led Growth Approach

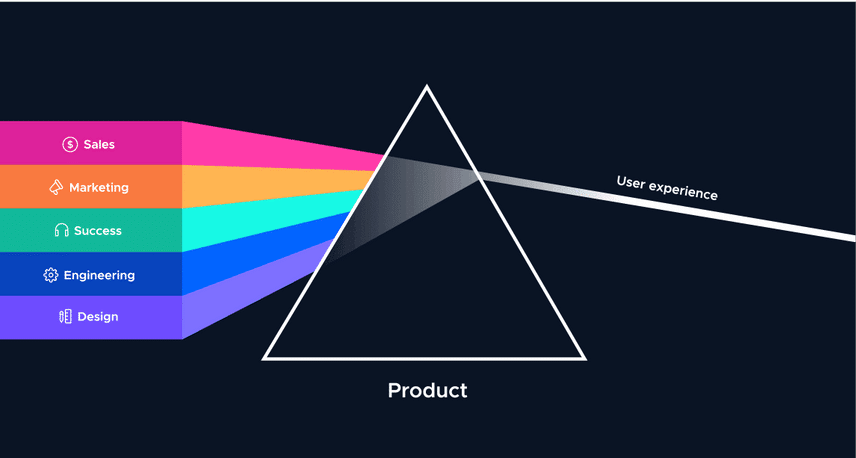

Product-led growth is an increasingly popular SaaS tactic that implies driving growth, i.e. acquisitions, expansions, conversions, and increased retention, through the product itself. That means coming up with a user experience so good it practically sells itself.

PLG is also proven to lead to consistently lower CAC payback periods.

Here are some advantages of the product-led approach to lowering CAC payback:

- You’re drastically cutting CAC, therefore directly affecting your payback period.

- You can redirect that acquisitions budget to improving your product and UX, further increasing the potential of your PLG approach.

- Users who love your product are already loyal and have increased stickiness.

- You can also implement product-led marketing, allowing users to share their achievements with colleagues, friends, or on social media, increasing visibility and bringing in referrals.

Illustration of Product-led Growth (PLG) from ProductLed.org

Mistakes when Using CAC Payback Period

As a CEO in the SaaS industry, I’ve witnessed firsthand how overlooking certain pitfalls in managing CAC Payback Period can lead to skewed financial projections and strategic missteps. Here are some common pitfalls I’ve observed:

Not considering the time value of money

Money typically devalues over time due in large part to inflation. So while you may be looking at a decent payback period right now, the same might not be true a few years down the line. This is why it’s important to continuously monitor both CAC Payback Period AND LTV:CAC, all while keeping up with industry benchmarks.

Not factoring in the compounding cost of customer churn

Customers that leave during the payback period pass on their acquisition costs to the next acquired customers. Now imagine that 10 customers churn and you secure 10 new customers. Those new customers will have a greater payback period because you have to factor in CAC for 20 customers.

Overlooking the Quality of Acquired Customers

It’s not just about acquiring new customers; it’s about acquiring the right ones or matching your ICP profile as best as possible. Companies often fall into the trap of prioritizing quantity over quality. High churn rates among newly acquired customers can inflate your CAC and distort the payback period. The key is to refine your targeting and onboarding processes to ensure a better fit between your product and your customers.

Neglecting the Impact of Market Changes

The market is always evolving, and what worked yesterday might not work today. A common mistake is to rely on outdated benchmarks or historical data without considering current market dynamics. Stay agile and continuously update your strategies based on the latest market trends and consumer behaviors.

Underestimating Indirect Costs

Direct marketing and sales costs are easy to track, but indirect costs like support, infrastructure, and technology often get overlooked. These costs can significantly impact your CAC calculation and, consequently, your payback period. Ensure that all relevant costs are accounted for in your CAC calculation.

Failing to Align Teams Around CAC Goals

CAC Payback Period is not just a concern for the finance team; it’s a company-wide metric. A common pitfall is the lack of alignment between marketing, sales, customer success, and product teams. Regular cross-departmental meetings and shared KPIs can foster a more cohesive approach to managing CAC.

Ignoring Customer Lifetime Value (LTV)

Focusing solely on CAC Payback without considering LTV can give a myopic view of customer profitability. It’s crucial to balance short-term acquisition costs with long-term customer value. Develop strategies that not only reduce CAC but also enhance the LTV of your customers.

Kyle Poyar, Operating Partner at Openview, has three more common mistakes in using CAC Payback Period:

Summing Up

To sum up, we’ve went on a real journey through the troubled waters of CAC Payback Period – a fantastic SaaS metric with many potential insights to offer. Moving forward, we hope you’re now equipped to understand its value, what you can bring to the table by simply measuring it, and how to go about that.

As always, for more in-depth breakdowns of complex SaaS topics, keep your eyes on the Custify blog.