So many customer success teams today live under constant pressure to up the company’s revenue – with net revenue retention (NRR) being the most common measure of their success.

To help you and your team get ahead, let’s take a closer look at this all-important SaaS metric:

- what it represents

- why CFOs swear by it

- how to measure it

- how to increase it

Along the way we’ll also look at what various leaders of the CS space think about net revenue retention and how they help their teams conquer it.

What Is Net Revenue Retention?

Net Revenue Retention (NRR) is a percentage indicating how much of the revenue from your existing customers you’ve managed to keep over a given period. NRR includes any expansion revenue (upsells or cross-sells), as well as downgrades and cancellations but does not include revenue from new customers during that same period. As such, NRR is a great indicator of how healthy a business is.

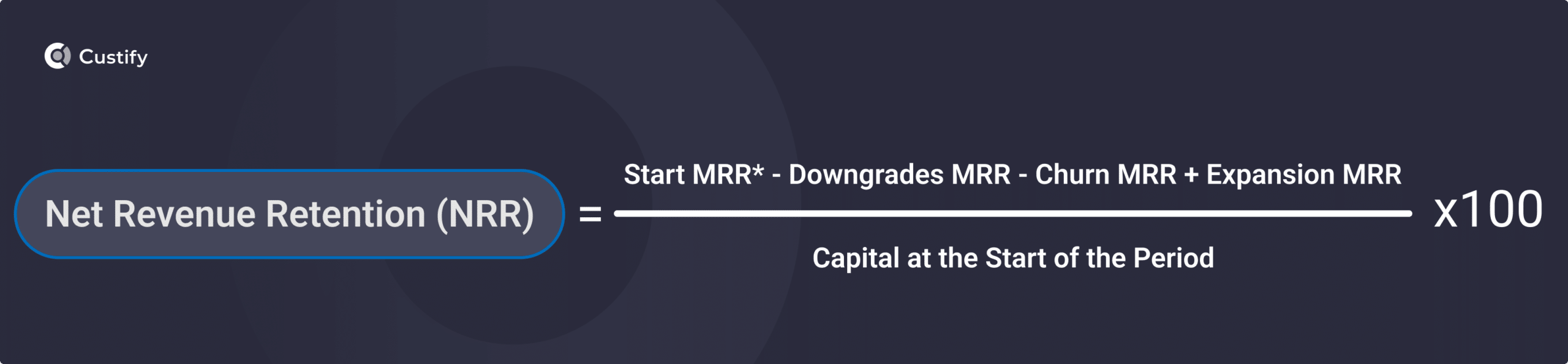

Net Revenue Retention Formula

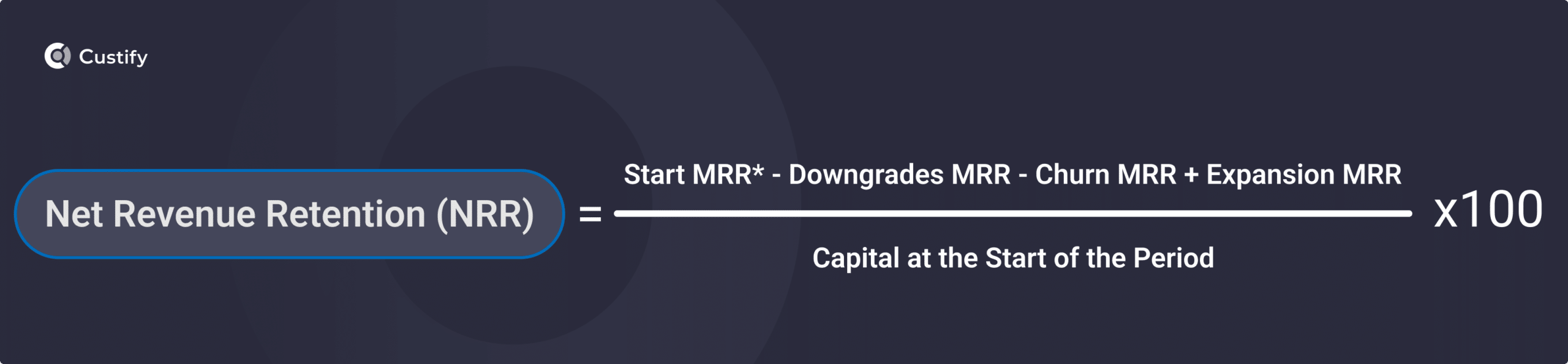

The gist of the formula is this: all your revenue at the start of a period, minus all the revenue you’ve lost during the period, plus any expansion revenue. Divide that by your starting capital and make it a percentage and voilà: your net revenue retention rate.

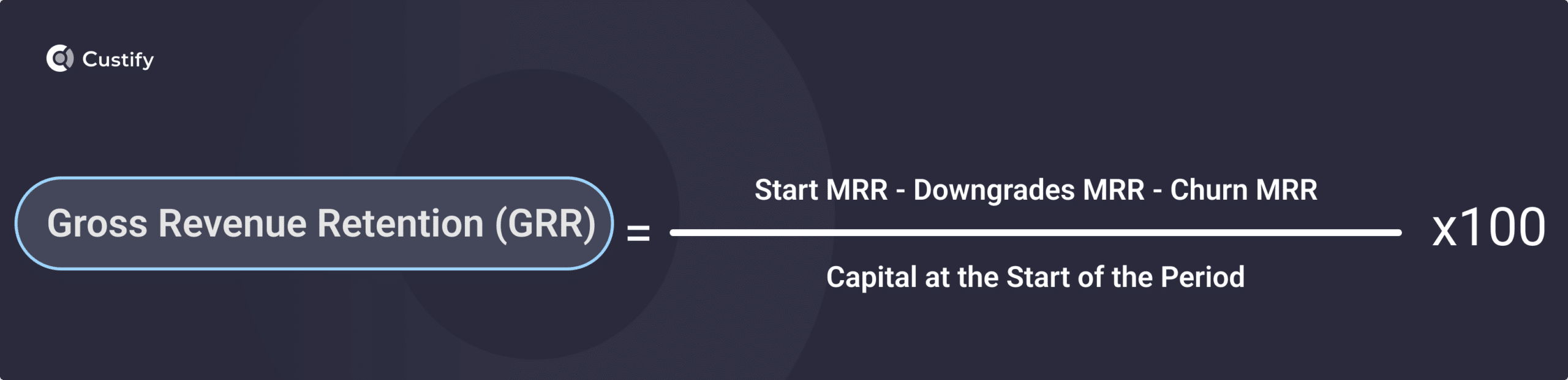

Net Revenue Retention vs Gross Revenue Retention (NRR vs GRR)

The main difference between NRR (Net Revenue Retention) and GRR (Gross Revenue Retention) is the latter does not account for expansion revenue, thereby giving a more accurate overview of retained revenue at the expense of an accurate view of profitability, offered by NRR.

The two metrics are good to track and important within customer success, and they typically have distinct use cases. Perhaps the best way to view the differences is by looking at the NRR formula above and comparing it to the GRR formula below:

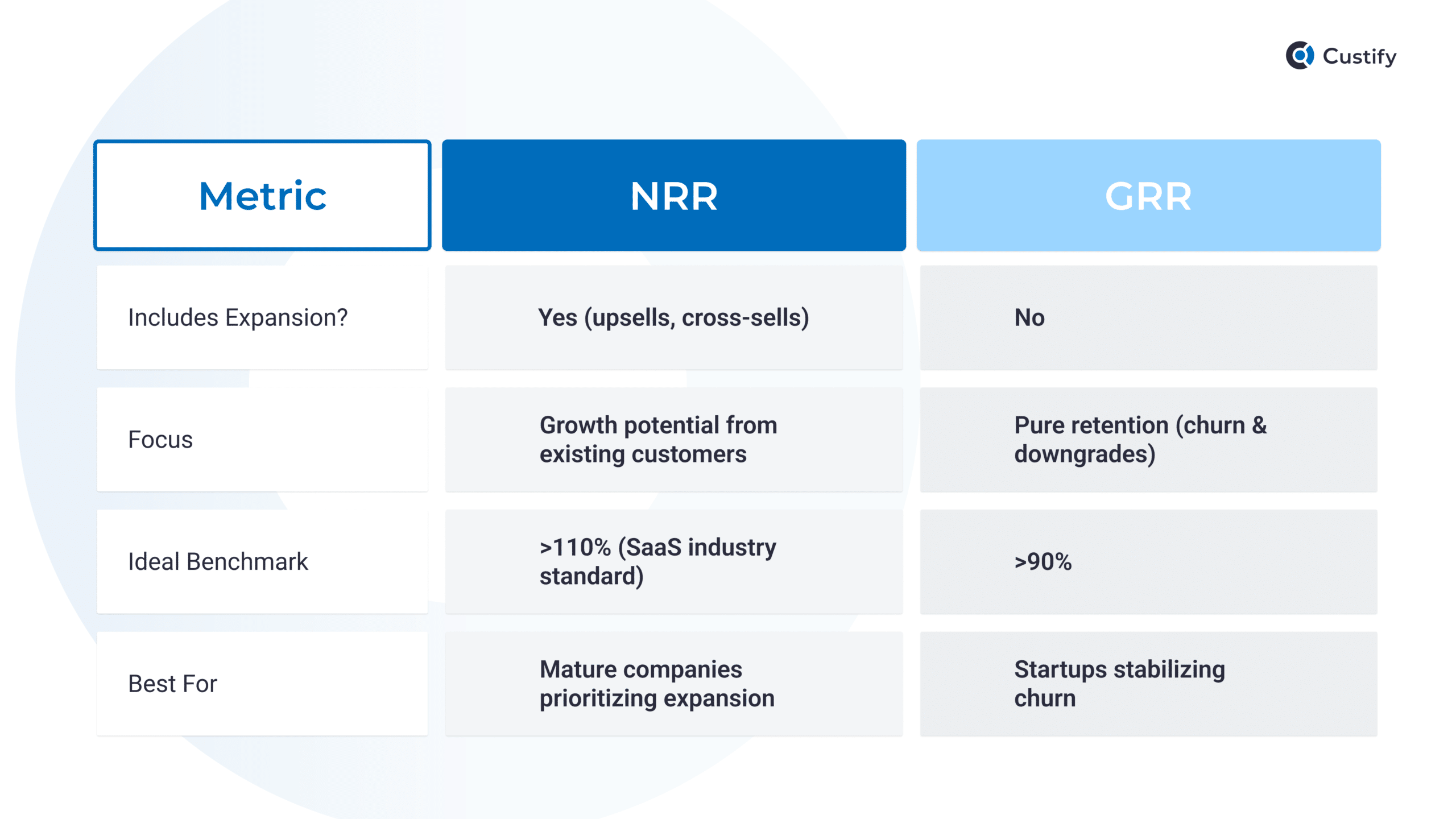

Net Revenue Retention vs. Gross Revenue Retention (NRR vs. GRR): When to Use Which

While both metrics measure revenue retention, their applications highlight different aspects of your business health:

Why the Difference Matters

Scenario 1:

A SaaS company with 95% GRR but 125% NRR is losing 5% of its base revenue yet growing 25% through expansions. Investors see this as a growth engine.

Scenario 2:

A company with 98% GRR and 102% NRR has minimal churn but lacks expansion muscle—a red flag for scaling.

When to Prioritize GRR:

- Early-stage startups need to prove retention basics.

- Industries with rigid pricing (e.g., utilities) where expansions are rare.

When to Obsess Over NRR:

- Scaling SaaS businesses leveraging upsells.

- Companies adopting usage-based pricing models.

The Pitfall of Mixing Metrics Example

One fintech startup celebrated a 105% GRR but overlooked the fact that their NRR had plummeted to 85% due to failed upsells.

Lesson: GRR can hide expansion gaps—always track both metrics.

Why Is Net Revenue Retention Important?

As CS evolves, budget constraints and financial woes have put pressure on our departments to deliver more revenue and prove their worth. Recent surveys show 62% of CSMs use it as their key metric, while 28.9% use GRR (CS Trends 2025). I believe that is slightly unfair, but not unexpected. This focus on NRR puts a lot of pressure on teams to prevent churn as well as drive up expansions.

I believe you don’t need to sacrifice customer value to drive revenue. In fact, that’s the whole point of customer success – through our work we provide value and grow revenue. The metric you pick as your north star will undoubtedly influence that, and so it must always be aligned with your team. If you have a small CS team that’s busy trying to reduce churn, GRR might be a better metric for you as it removes Expansion from your purview. If, however, you have both CSMs in charge of churn reduction and CSMs leading the upsell / cross-selling initiatives, then NRR could give you a good birdseye view of the bottom line.

Tracking revenue retention on the whole is useful for other reasons as well:

- It shows your potential for growth. By looking at NRR and Churn Rate, LTV, and CAC Payback, you start to get a full picture of your growth prospects and are thus able to approach expansion methodically.

- It serves as a health monitor for your business. I like to look at NRR like a heart monitor for the business – if it beeps too slow, it means you’re not retaining enough revenue. If it beeps too fast, it means you’re not obtaining enough expansion MRR.

- It helps prevent churn. By simply figuring out if you have glaring retention issues, you can prepare yourself for future churn and work to prevent it.

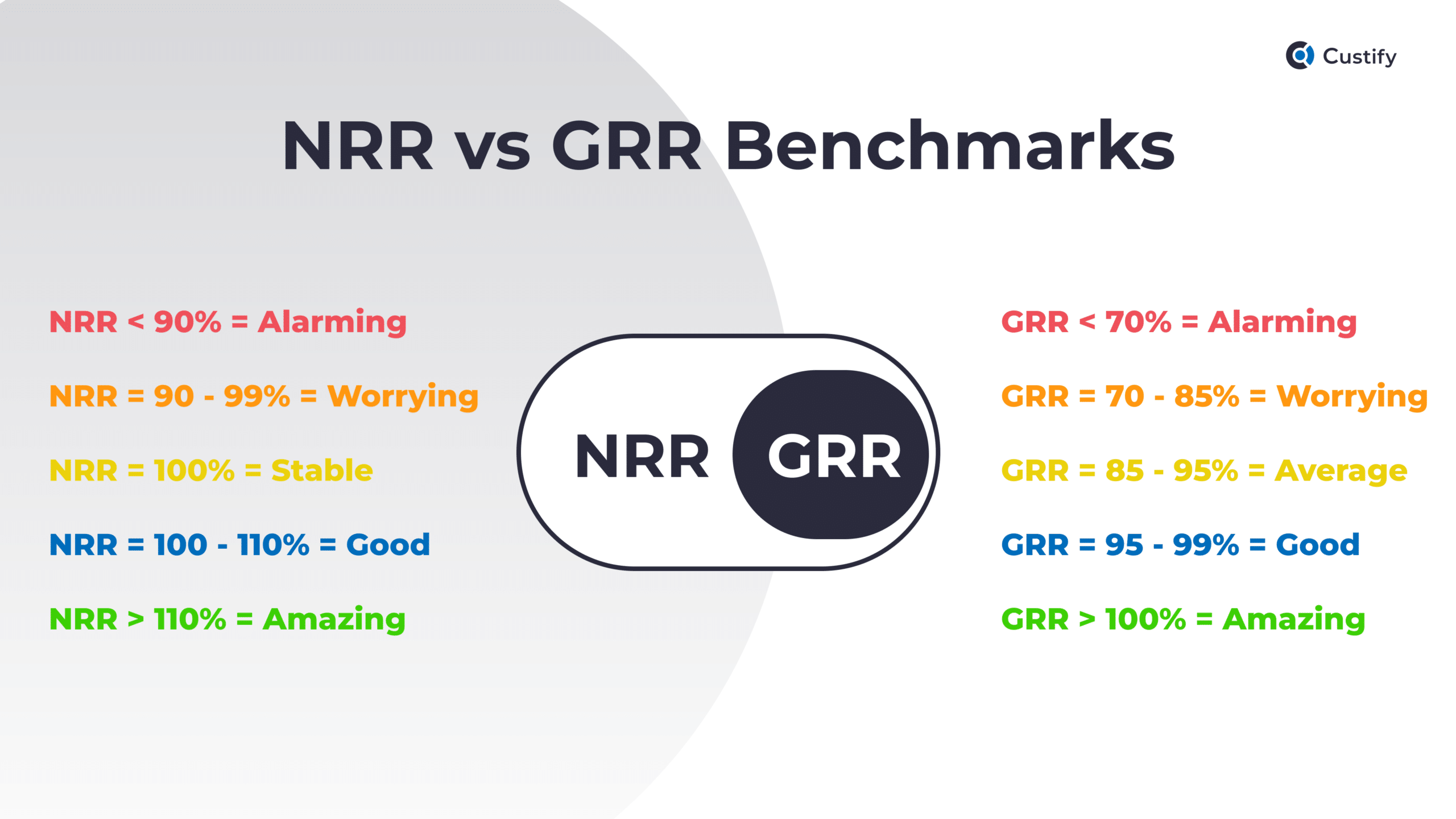

What Is a Good Net Revenue Retention?

When it comes to benchmarks for good NRR, the general consensus is that an NRR over 100% is great, and one over 110% is ideal. The logic is that while 100% means Expansion MRR makes up for Churn and Downgrades MRR, over 100% means you’re generating more Expansion revenue than what you lost on Churn and Downgrades.

Conversely, an NRR under 100% would classify as a sign things aren’t going so well. It’s not disastrous, but you should be looking at your churn rate and your expansion rate and figure out how to improve both to get NRR back in the green.

Under exceptional circumstances, your NRR and even GRR could go over 100% without significant expansion revenue. This is more often than not a result of pricing changes – where you raised the price of your product or services and most or all of your customers agreed to the new price.

Does Net Revenue Retention Include New Customers?

There’s a simple answer to this question: no, NRR does not include revenue obtained from new customers. I can understand the confusion however, as NRR does include revenue obtained from expansions – i.e. upgrades, feature additions, and add-ons on existing accounts. However, new accounts (aka accounts obtained during the period for which you are measuring NRR) do not figure into the equation.

Common Challenges with Measuring or Improving NRR

Here are some common challenges to measuring and improving NRR along with suggestions to overcome them based on my experience working in CS:

- Improper measurement and tracking tools. A good CS team will always have the tools they need at their disposal – typically meaning a good customer success platform, a good CRM, and a few other CS software essentials.

- Incomplete data and missing data points. Having good tools is not enough – they must also be properly set up for your success. That means giving the lead CSM time to set things up and the clarity to know what to measure (in our case, NRR).

- Misaligned cross-functional efforts. Poor internal alignment is also a common pitfall of measuring NRR. It may be that your CRM is sending erroneous data to your CSP. It may be that reporting from sales or from other CSMs is lagging, leaving you guessing with outdated numbers. To combat this, make sure everyone understands what the KPIs are, how to measure them, and when to compile their reports.

- Lack of proper sales training. In order for CSMs to master expansion, they need to understand the sales mindset. That means receiving sales training (if they’re not already equipped for upsells and cross-sells). Alternatively, they can collaborate with Sales on expansion – a model which can work beautifully for some companies.

- Increased focus on expansions. To follow up on my previous point, too much focus on expansion can lead to lower NRR. Why? Because if all your CSMs are concerned with Sales, you won’t have any left to anticipate churn and protect what you already have. Remember, it’s called “retention” for a reason.

How to Calculate Net Revenue Retention

To calculate NRR, you simply have to use the formula we mentioned above. To help you even further, let’s repeat it and break it down. After the detailed review, I’ll attach a free Google Sheets template you can copy and use as an NRR calculator.

*MRR = Monthly Recurring Revenue

Now I’m going to look at each factor of the equation one by one:

- Start MRR. The monthly recurring revenue (MRR) you have at the beginning of the period for which you’re trying to measure. Other names: beginning recurring revenue, starting MRR, MRR at start of month.

- Downgrades MRR. The recurring revenue lost from subscription downgrades during the period for which you’re trying to measure. Other names: MRR lost from downgrades, contractions.

- Churn MRR. The recurring revenue lost from customers lost during the period for which you’re trying to measure. Other names: churned MRR, MRR from lost customers.

- Expansion MRR. The recurring revenue gained as a result of upsells, cross-sells, feature add-ons and any other form of expansion, during the period for which you’re trying to measure. Other names: expansions, expansion revenue.

- Capital at the Start of the Period. In most cases this is equal to the Start MRR. Unless your CFO tells you otherwise, simply use your starting MRR. Other names: capital

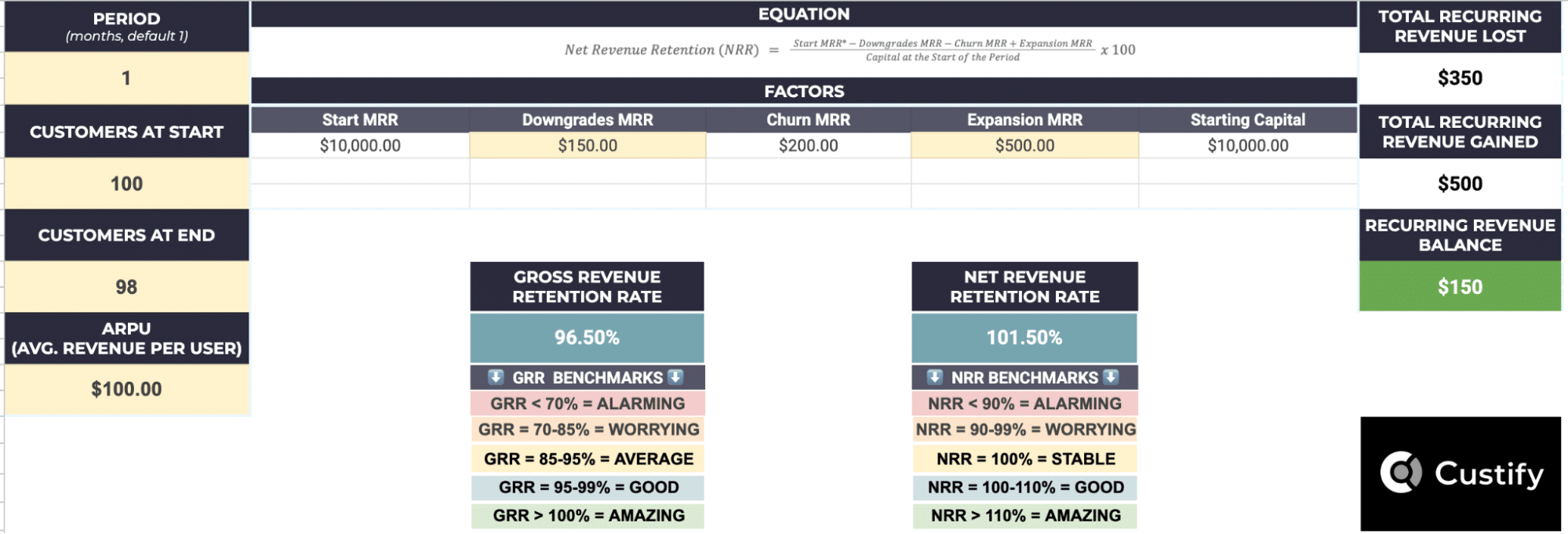

How to Calculate Net Revenue Retention in Excel / Google Sheets

To make it easier for all of you out there, I put together a spreadsheet calculator that you can copy to your Google Drive and fill in to get your NRR and GRR quickly and easily:

[Custify] MRR and GRR Calculator

Two mentions here:

- To calculate your Annual Retention Rate (ARR), simply use the same formula over a 12-month period.

- If you want your calculations to be more precise, I recommend using the calculator above once for each customer cohort / segment, based on subscription tiers or ARPU.

Tools for Tracking Net Revenue Retention

To ensure you’re tracking all your SaaS metrics correctly and are able to calculate your NRR / GRR, you should be using the correct tools. In fact, according to ChurnZero, 57% of CS teams that work with a customer success platform saw their NRR grow above 100%.

Here are some tools that can help:

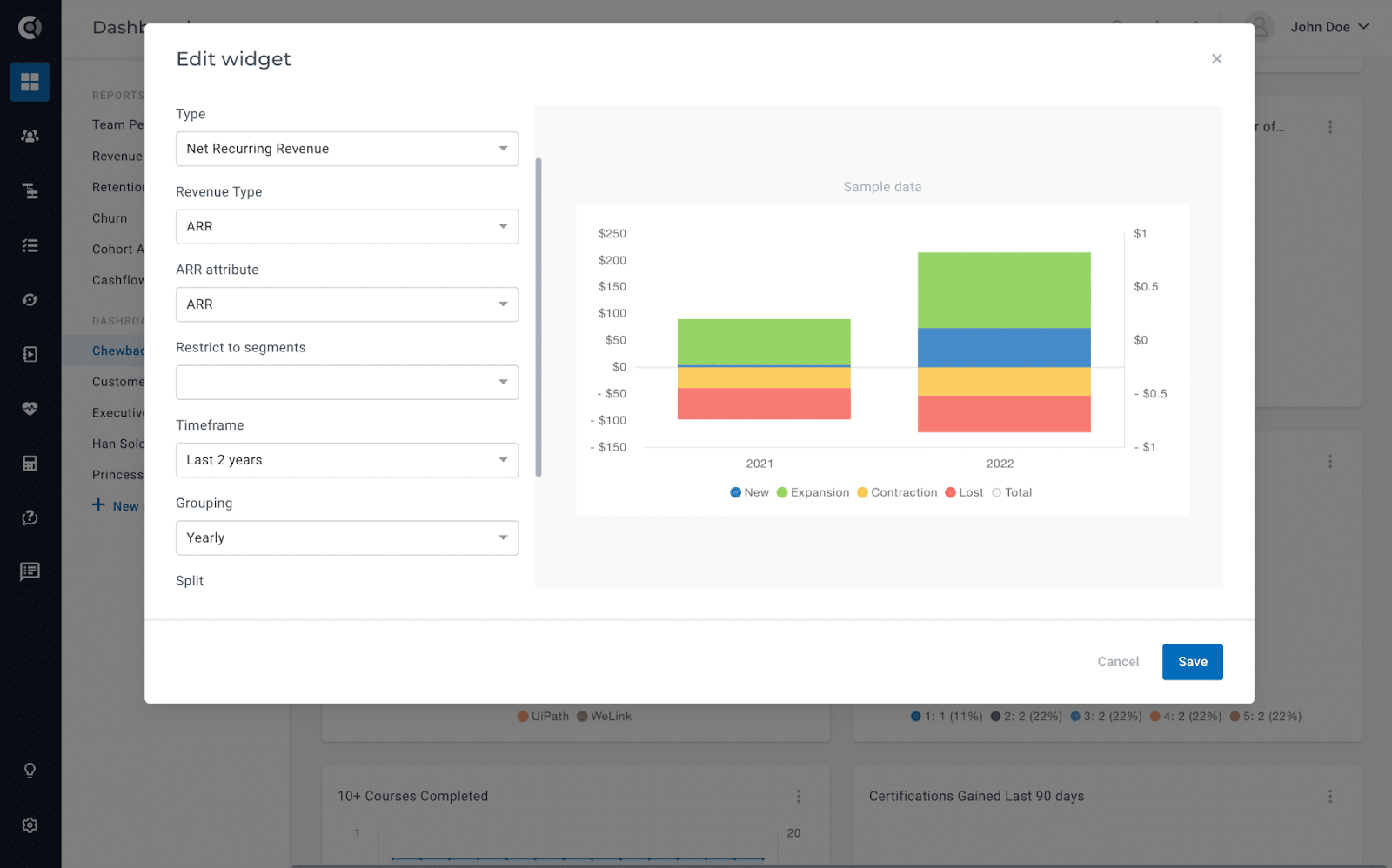

1. Custify. Our CSP allows you to keep track of your NRR at any point, in real time. Custify integrates with most of your SaaS tech stack to gather accurate data seamlessly between tools. Once your setup is complete, you can use your financial data to create an NRR Widget and add it to your customer success dashboard and reports, thus monitoring NRR for any specific timeframe.

2. BI Platforms. Business intelligence tools such as Power BI or Segment allow you to track any metric that is important to your business, including NRR and GRR. Furthermore, you can use the vast array of tools at your disposal in these platforms to generate highly complex fiscal reviews and amaze your CFO on your next company call.

3. CRM. Another place where you can track NRR and GRR is your CRM. Most CRMs have the option of tracking recurring revenue. Some examples include Hubspot, Close CRM, CharMogul.

4. Billing Software. Your financial infrastructure tool, such as Stripe, can also monitor your NRR. However, in my experience payment platforms don’t have all the data required to correctly calculate NRR.

How to Increase Net Revenue Retention?

1. Encourage and Incentivize Product Usage

According to Bain and Company, many more companies are moving towards usage-based pricing, which decreases the overall effectiveness of your classic retention strategies. Shifting to a more purposeful approach that encourages and even incentivizes product usage is one of their proposed solutions.

- Master implementation. One of the main responsibilities of customer success, implementation ensures clients have all they need to make the most out of your product. A good implementation process increases product usage, accelerates value realization, and makes customers feel their needs are addressed.

- Focus on increasing adoption. The goal of onboarding and implementation is to make sure customers’ entire user base adopts the product, understands how to use it, and integrates it in their day-to-day operations. By the end of this stage in the customer journey, they should feel your product is complementary to their business outcomes and an essential part of delivering them.

- Generate value and excitement. Customer value addition must start as early as possible in their lifecycle. To increase NRR even further, you can work with Product and Marketing on a product-led growth approach – incentivizing usage and creating shareable moments, with special attention given to extra features and higher subscription plans. This will highlight the added value customers can get through premium features and create demand for them.

2. Try Incremental Price Increases

Let’s take a closer look at the method suggested by Cristopher Warren Gash in the webinar snippet featured higher up in the article:

I believe this is a great tactic with good potential – if done right. You must gauge customer sentiment, understand whether or not you’re actually delivering a core value to justify the price change, and then move tactfully towards the price increase. For example, you should avoid advertising big discounts for new customers while old customers get a price increase. In fact, you should be rewarding long-term accounts for their loyalty, not punishing them just because they’re not new.

3. Track More than Just NRR

Having a one-track mind set on NRR can be detrimental to your business and to the NRR itself. Customer success is a function that oversees a diverse range of tactics, all of which need to be monitored closely to ensure success in your overall efforts.

Saahil Karkera echoed a similar point in one of our webinars:

While your CFO and other C-suite executives might insist on NRR as your north-star metric, it’s up to you, as a CS leader, to sift through the data and handpick other numbers to complement NRR and tell you a bigger story of your solvency at any given moment.

4. Build Trust in Your Customer Experience

Another great piece of advice is to fundamentally shift your approach to customer experience. It’s not enough that your onboarding and implementation help customers use the product, their experience through those early stages must also be seamless, smooth, and tailored to their needs.

Here’s Peter Ord with more on this:

At the end of the day, we always make judgement calls about our purchasing decisions. It’s in our nature to look for the best deal, and that applies particularly to the products and services we choose for our business. A lot of these decisions go beyond simple math, they are inextricably linked to how we feel about a company, a product, or the lead CSM for our account. So taking special care in making your CX as nice as possible will always work out in your favor.

Summing Up

No matter how the SaaS space will evolve in the following years, NRR will undoubtedly continue to be the leading key performance indicator for our entire customer success ensemble. And just like with an orchestra, if one instrument is poorly tuned, the whole performance suffers. That’s why we as customer success leaders must continue to ensure every section of our team – from onboarding to implementation and from expansion to offboarding – is perfectly balanced.

To help you fine tune your CS efforts, Custify offers premium, concierge onboarding to all our clients. Me and my CS team are always excited to hear about the next breakthrough SaaS product we can help with our platform – so don’t hesitate to reach out, even for just a chat!