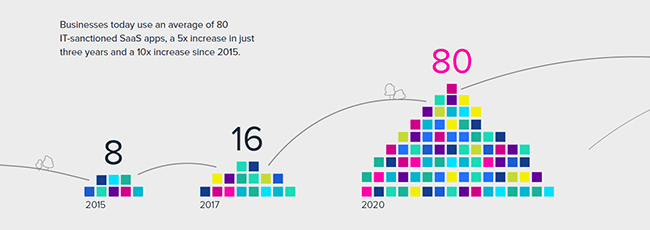

If you’re in the business world, especially within the SaaS space, you’re no stranger to the monumental shift we’re experiencing toward subscription-based services. Businesses estimate that 70% of the apps they leverage run on the SaaS model. With this model’s growing prominence, it’s crucial to understand the unique financial side – SaaS payment processing.

Simply, SaaS payment processing is the backbone of your revenue stream. The digital gateway allows you to accept and manage recurring payments from your customers, no matter where they are.

SaaS businesses require a specialized service with their unique recurring revenue model and international client base.

It’s not just about getting paid; it’s about creating a seamless experience for your customers, managing global transactions effectively, and having the tools to minimize customer churn. That’s why choosing the best SaaS Payment Processing Service is a decision that deserves your full attention and careful consideration.

Understanding SaaS Payment Processing

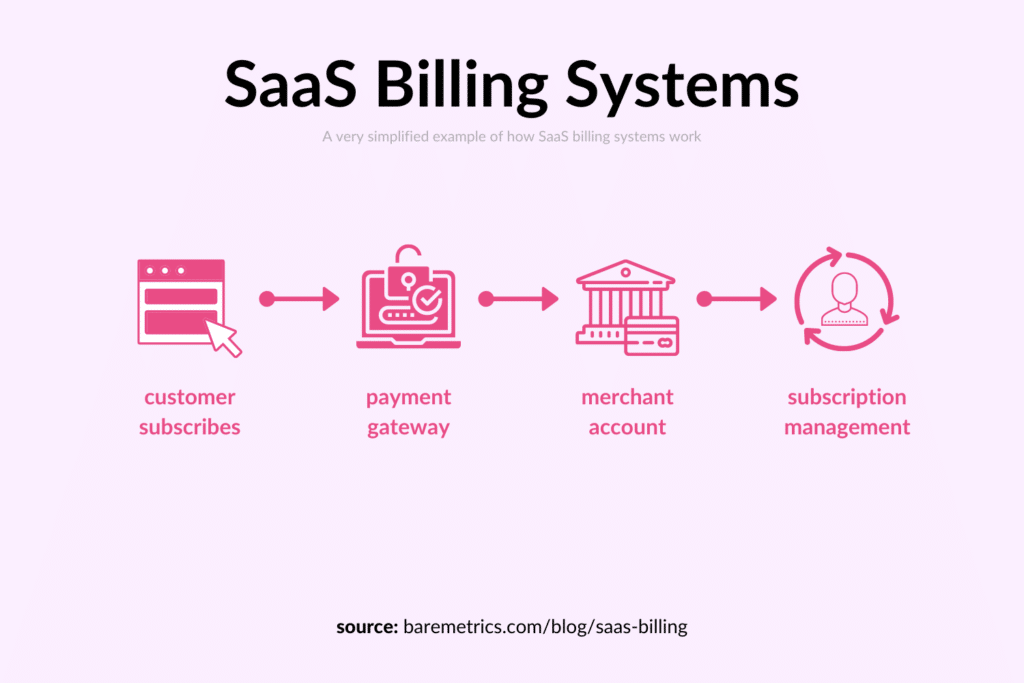

So, what exactly is SaaS payment processing? Let’s break it down in simple terms:

SaaS payment processing is the digital system allowing Software as a Service business to handle recurring customer payments. This system works in the background, almost invisibly, to facilitate the secure exchange of money from the customer’s account to the business’s account.

It’s like having a digital cashier who never sleeps. Every month (or year, depending on your subscription model), your payment processor checks in with your customers’ bank accounts or credit cards. It asks, “Hey, is the monthly subscription fee available?” If yes, it smoothly transfers the money to your account.

You might wonder why you can’t use any old payment processor for your SaaS business. Here are a few key reasons why SaaS businesses need a specialized payment processor:

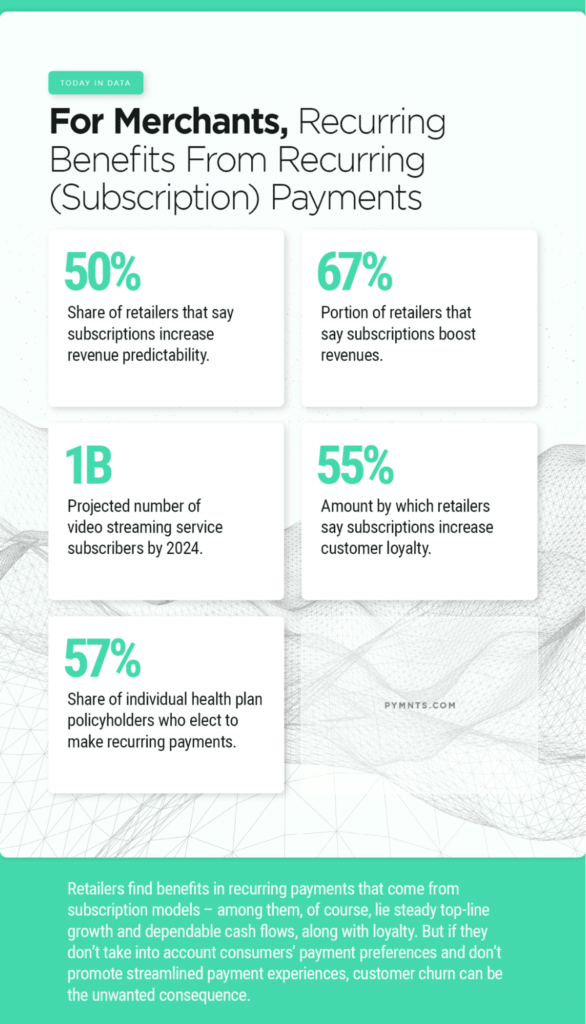

- Recurring Payments: Unlike traditional businesses with one-time transactions, SaaS businesses run on a subscription model, meaning you need a system that can handle recurring payments like a pro.

- Global Transactions: SaaS businesses often have customers all around the world. A SaaS payment processor can handle multiple currencies and payment methods, so you can accommodate customers wherever they are.

- Customer Churn Management: Payment failures can lead to involuntary churn. A specialized SaaS payment processor can help you minimize this by smartly retrying failed payments and sending customers alerts about expiring credit cards.

- Reporting and Analytics: Knowing your MRR, ARR, churn rate, and other key metrics is crucial for a SaaS business. A specialized processor can provide these insights directly tied to your payment data.

Think of your SaaS payment processor as a team member who handles an essential job. They take care of the financial transactions, so you can focus on what you do best – creating a fantastic software solution for your customers.

The Challenges of SaaS Payment Processing

Navigating the world of SaaS payment processing has its challenges. While a specialized payment processor can solve many issues, it’s crucial to understand the potential obstacles that could impact your revenue and customer experience.

Here are some of the most common challenges that SaaS businesses face:

1. Adjusting to Real-Time Changes in Billing Plans

In a subscription-based business, customer needs and preferences are constantly evolving. They can upgrade, downgrade, add new users, cancel, or renew subscriptions. Here’s why these changes matter:

- Flexibility is Key: Your billing system must adapt to real-time changes. This is not just about retaining current customers but also about enhancing their experience with your service.

- Legacy Plan Transitions: Handling old plans that no longer exist can be cumbersome. A seamless method for transitioning these into current plans is vital.

- Customer Loyalty: Unlike traditional business models focusing only on initial sales, subscription-based businesses rely on ongoing payments. Adjusting to customer preferences in real-time fosters loyalty.

- Solution: Integrating a customer relationship manager (CRM) tool with your billing system can make these adjustments smoother, ensuring a superior customer experience.

2. Automating Invoices

Managing various tiers, packages, and billing cycles manually is unsustainable, especially as your subscriber count grows. Here’s why automating this process is essential:

- Time-Consuming Manual Process: Manual invoicing involves multiple steps, and agents can cost businesses an average of $171,000 annually.

(Source: Payments Canada) - Electronic Invoicing Benefits: Electronic invoicing simplifies the process, cutting down the wait time and steps in generating and completing payment.

(Source: Payments Canada) - Tools Like Regpack’s Auto-Billing System: Automated systems can significantly improve efficiency. With features like percentage-based plans, control over payoff timelines, and private plans accessible only by your team, automation streamlines invoicing. Regpack clients have seen a 25% improvement in cash flow and a 35% payment rate increase.

3. Establishing Flexible Recurring Billing Frequencies

Flexibility in billing frequency is a requirement for many businesses, especially those that wish to offer more than just flat-rate charges or rigid payment schedules. Here’s what to consider:

- Complex Payment Preferences: To offer your customers more flexibility, you need a recurring payment system to manage more complex billing structures.

- Frequency Concerns: Too frequent billing might cause friction, leading to customer dissatisfaction and increased churn. The best billing frequency for most recurring billing services is monthly or annually.

- Match Customer Preferences and Business Goals: When determining billing frequency, aligning with customer preferences and business growth objectives is crucial.

- Solution: A reliable automated subscription billing system, adaptable to varied subscription tiers and payment plans, ensures a smooth process for you and your customers.

4. Managing Failed Payments

Managing failed or missing payments is more than an annoyance; it potentially threatens your revenue and customer retention. Here’s why it’s a critical concern:

- Payment Failure Frustration: Nothing is more disappointing than a payment failing during processing. It not only disrupts your cash flow but can also erode trust with your customers.

- Risk of Customer Churn: Failed payments without follow-ups might lead customers to look elsewhere for services. Since customer retention has a higher ROI than acquiring new customers, managing this aspect is vital.

- Increasing Company Value: Even a modest 10% increase in customer retention rates can result in a 30% rise in your company’s overall value.

- Solution: Choosing an automated recurring billing system that can send reminders and failed payment notices, known as dunning emails, is essential. Providing detailed payment analytics also allows your team to monitor and act promptly.

Top SaaS Payment Processing Services

In the rapidly evolving world of SaaS, several payment processors have distinguished themselves by offering robust features explicitly tailored for subscription-based businesses. While we’re not endorsing any particular service, it’s worth knowing the top players in the field. Here’s a brief introduction to some of the leading SaaS payment processors:

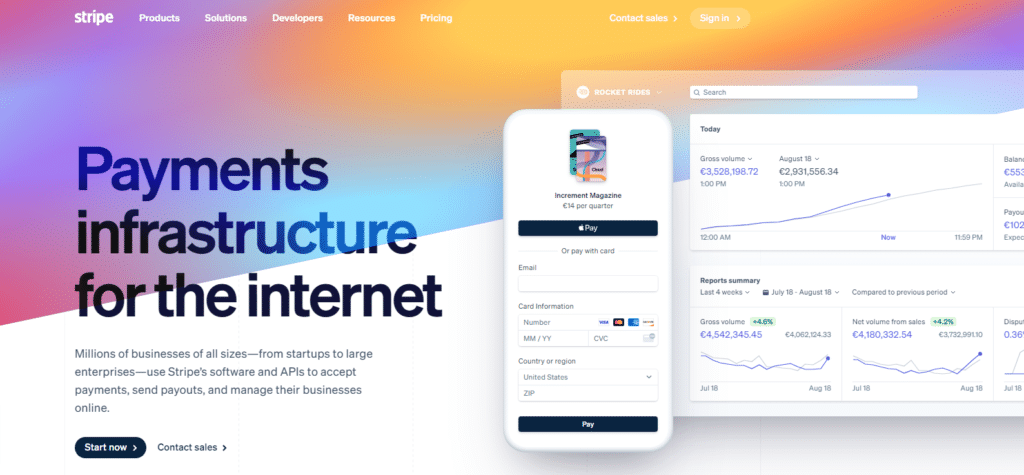

1. Stripe

Stripe is a cutting-edge payment processing platform that transforms how businesses handle transactions. With advanced features and global capabilities, it’s the go-to solution for simplifying payments and expanding reach.

Primary Features & Advantages:

- Unified Platform: Stripe offers a single platform for online payments, in-person transactions, and subscription management.

- Global Reach: With support for over 135 currencies, Stripe enables businesses to expand globally.

- Developer-Friendly: Easy-to-integrate APIs and comprehensive documentation make Stripe a favorite among developers.

- Subscription Management: Advanced tools for subscription billing, proration, and trial management streamline SaaS services.

- Security: Stripe boasts robust security features including PCI-DSS compliance, tokenization, and real-time fraud detection.

- Customizable Checkout: Create seamless checkout experiences with customizable payment forms and embedded checkouts.

- Invoice Creation: Generate and send professional invoices, facilitating efficient billing and reducing administrative overhead.

- Mobile Optimized: Stripe offers mobile SDKs for smooth in-app payments, enhancing the mobile customer experience.

Main Disadvantages:

- Learning Curve: While developer-friendly, Stripe’s features might require a learning curve for non-technical users.

- Support Complexity: Some users report challenges in getting prompt customer support responses.

- Payout Delays: Payout schedules might be delayed for certain businesses, impacting cash flow.

Pricing:

2.9% + 30¢

per successful card charge

2. PayPal

PayPal redefines the way businesses and individuals handle online transactions. Its user-friendly platform and global acceptance make it a trusted solution for secure and seamless payments.

Primary Features & Advantages:

- Global Reach: PayPal is accepted in over 200 countries, making it ideal for businesses with international customers.

- Buyer Protection: Offers strong buyer protection policies, boosting customer confidence in online purchases.

- Easy Integration: Simplified integration with various e-commerce platforms and websites, suitable for all business sizes.

- Mobile Payments: Offers user-friendly mobile apps for buyers and sellers, enabling seamless mobile transactions.

- Invoicing: Facilitates easy invoice creation and payment processing for freelancers and small businesses.

- Flexible Payment Methods: Supports credit/debit cards and bank transfers, providing customers various payment options.

- PayPal Credit: Allows eligible customers to purchase and pay later, potentially increasing cart values.

- One Touch Checkout: Enhances user experience with the “One Touch” feature for quicker and more secure checkouts.

Main Disadvantages:

- Transaction Fees: While competitive, PayPal charges transaction fees that can impact small businesses.

- Account Freezes: Users occasionally report account freezes due to perceived security concerns, causing inconvenience.

- Limited Seller Protection: Sellers may face challenges with chargebacks and disputes, affecting their revenues.

Pricing:

From 2.29% to 3.49% depending on the transaction type

3. Braintree

Braintree redefines payment solutions with its advanced suite of tools, making transactions seamless and secure.

Primary Features & Advantages:

- All-In-One Platform: Braintree offers a comprehensive suite of tools for accepting, processing, and managing payments.

- Global Acceptance: It supports transactions in over 130 currencies, making it suitable for businesses with international customers.

- Secure Vault: Braintree’s vault securely stores customer payment information, reducing PCI compliance scope.

- Customizable Checkout: Allows businesses to design and embed a customized checkout experience on their websites.

- Seamless Integrations: Easy integration with various e-commerce platforms, enabling smooth payment processing.

- Subscription Billing: Offers advanced subscription management tools for SaaS and recurring businesses.

- Mobile-Friendly: Provides mobile SDKs for in-app payments, enhancing mobile customer experience.

- Fraud Protection: Comes with built-in fraud protection tools, reducing the risk of chargebacks and fraudulent activities.

Main Disadvantages:

- Learning Curve: Some users might find Braintree’s advanced features require a learning curve.

- Customer Support: Occasional reports of slower customer support responses during peak times.

- Technical Focus: While developer-friendly, non-technical users might find certain aspects challenging.

Pricing:

2.59% + $.49 per transaction

4. Chargebee

Chargebee is a cloud-based subscription management and recurring billing solution designed for businesses of various sizes. It helps businesses manage subscriptions, billing, invoicing, and revenue operations.

Primary Features / Advantages:

- Recurring Billing Automation: Chargebee automates the billing process, ensuring customers are billed accurately and on time.

- Flexible Pricing and Discounts: Users can customize pricing models, offer discounts, and set up trials.

- Dunning Management: Helps businesses handle failed payments by sending automated reminders and managing retry logic.

- Advanced Analytics: Provides insights into revenue, churn, and other key subscription metrics.

- Tax Management: Automates tax calculations and invoicing for global transactions.

- Integration Capabilities: Chargebee integrates with various other tools, including payment gateways like Stripe, accounting software like QuickBooks, and CRM tools like Salesforce.

- Secure: Ensures compliance with standards like PCI DSS for payment data security.

Main Disadvantages:

- Learning Curve: Chargebee might have a slight learning curve for those unfamiliar with subscription billing.

- Cost: For startups and smaller businesses, the pricing might be a consideration depending on the volume of transactions.

- Customization Limitations: Chargebee is highly customizable, but workarounds might only achieve specific use cases or workflows.

- Integration Nuances: While Chargebee supports integrations, users might sometimes face issues or limitations integrating with specific tools.

Pricing:

Starter: USD 0

for your first USD 250K of cumulative billing; 0.75% on billing thereafter

Performance: USD 599

for up to USD 100K of billing per month; 0.75% on billing thereafter

5. Zuora

Zuora is a leading cloud-based subscription management platform that provides businesses with the necessary tools to launch and manage subscription services. Zuora focuses on automating recurring billing, subscription quoting, revenue recognition, and more.

Primary Features / Advantages:

- Subscription Billing Automation: Zuora automates the end-to-end subscription billing process, accommodating various pricing structures and billing scenarios.

- Zuora Central Platform is a hub for all your subscription order-to-revenue operations.

- Zuora RevPro: Helps in automated revenue recognition, ensuring compliance with accounting standards.

- Analytics: Provides insights into subscribers’ behavior, revenue growth, churn, and other crucial metrics.

- Customizable Pricing and Packaging: Allows businesses to seamlessly launch new products, bundle products, and modify pricing strategies.

- Global Payments: Supports over 30 payment gateways and multiple currencies, enabling businesses to expand globally.

- Integrations: Zuora can be integrated with various CRM, ERP, and other systems to ensure smooth workflow.

Main Disadvantages:

- Complexity: Due to its extensive features, there can be a learning curve for users unfamiliar with subscription management platforms.

- Cost: Depending on the size and needs of the business, Zuora might be more expensive than other solutions in the market.

- Implementation Time: Depending on the complexity of the business processes, the time to get Zuora up and running might be longer than expected.

- Customization Needs: Some businesses might need to invest in customizations or third-party integrations to get the desired functionality.

Pricing:

from $20/user/month

Key Features to Look for in a SaaS Payment Processor

When it comes to choosing a SaaS payment processor, it’s not a one-size-fits-all situation. Depending on the nature of your business, the ideal features of a processor may vary. However, here are some essential aspects you should consider:

1. Security

Your customers trust you with their sensitive data every time they make a transaction. To uphold this trust, ensure your processor adheres to PCI compliance standards and employs advanced fraud detection mechanisms.

2. Scalability

Your payment processor should be able to grow with you. As your customer base expands, the number of transactions will increase. Ensure your processor can handle the load without compromising performance.

After all, you would want to avoid a situation where the tool that boosts your revenue becomes a bottleneck in your growth.

3. Global Reach

Serving an international customer base is a significant advantage of SaaS businesses. Therefore, your payment processor should handle multiple currencies and regional payment methods comfortably.

This flexibility not only improves customer experience but also helps you penetrate new markets with ease.

4. User Experience

A seamless checkout and payment process can enhance customer satisfaction and reduce churn. Complex or lengthy checkout processes can lead to cart abandonment; you want something else.

Choose a processor that ensures customers can subscribe and pay with minimal clicks and maximum convenience.

5. Recurring Billing

Automating subscription and billing cycles is a must-have feature for SaaS businesses. The system should handle everything from initiating the first payment to managing failed transactions without you having to lift a finger.

Remember, efficient recurring billing isn’t just good for your peace of mind—it’s also key to reducing involuntary churn.

6. Robust Analytics

Information is power. A payment processor with robust analytics can provide valuable insights into your revenue trends, churn rates, customer lifetime value, and more. These metrics are vital for making informed decisions that drive growth and profitability.

Remember, the goal is to find a SaaS payment processor that fits your business perfectly. It’s worth taking the time to research and test out a few options before making your final choice. After all, this isn’t just about taking payments—it’s about optimizing your business for success.

Questions to Ask Potential SaaS Payment Processing Providers

Choosing the right payment processor for your SaaS business isn’t just comparing features and prices. It’s also about asking the right questions. As you evaluate potential providers, consider the following key questions to guide your decision:

- What are your security measures? Ask about PCI compliance, encryption, fraud prevention, and other security measures the provider has in place.

- How do you handle recurring payments? Look for automated billing, retry logic for failed payments, and alert systems for expiring cards.

- What currencies and payment methods do you support? Your provider should support multiple currencies and various local payment methods if you serve international customers.

- How user-friendly is your checkout process? Ask for a demo of the checkout process to evaluate its ease of use and customer experience.

- How does your system handle failed payments and involuntary churn? The provider should have robust measures to handle these issues and minimize their impact.

- What kind of analytics and reporting do you offer? Detailed, real-time reporting can provide invaluable insights for your business.

- Is your system scalable? Ensure the provider can handle your business’s growth and increased transaction volume.

- What is your pricing structure? Understand all potential costs, including transaction fees, monthly and setup fees, and hidden charges.

- What kind of customer support do you offer? Reliable and responsive customer support can be invaluable when encountering issues or needing guidance.

- Can your system integrate with our existing software? Integrating your CRM, accounting software, or other business tools can streamline your operations.

Final thoughts

Choosing the right SaaS payment processing service is a critical decision that can significantly impact your business’s operations, growth, and customer experience. It’s not just about processing payments—it’s about enabling a smooth, secure, and efficient transaction process that supports your business model and caters to your customer’s preferences.

As we’ve discussed, several factors come into play when evaluating potential providers. From security and global reach to user experience and robust analytics, each feature can contribute to the success of your SaaS business. And, let’s remember the recurring billing management, which is essential for subscription-based businesses like ours.

However, remember that there’s no one-size-fits-all solution here. What works for one business might not work for another. That’s why it’s crucial to understand your specific needs and ask the right questions when evaluating potential providers.

Finding the right SaaS payment processor might take time and research, but the outcome is worth it. After all, you’re laying the foundation for a system to support your business’s growth, streamline your operations, and contribute to a positive customer experience.

So, we encourage you to take a deep dive, explore the options, ask the tough questions, and choose a provider that best fits your business needs. Remember, the goal isn’t just to find a payment processor—it’s to find a payment partner who can contribute to your SaaS business’s success.