Within SaaS, there’s almost always a natural divide between CS and Sales.

Take an average Salesperson and ask them what they think of CS, they’ll say “they always complain but never think about how we have quotas to meet.” Viceversa, your average CSM would say that Sales “always bring in poor fit customers we have to manage.”

I can’t be the only one who’s said “there has to be a better way” – right? Well, today, I’m here to tell you there is, and it starts with churn data. Let me show you how it can be the starting point for a productive Sales <> CS relationship and a foundation for both teams to:

- Enhance lead qualification

- Reduce customer churn

- Improve strategic prospecting

- Drive organizational alignment and collaboration

Understanding Churn Patterns and Their Role in Sales Qualification

Looking at your customer churn says a lot about how your user base behaves, what they expect from your product, and how you’re meeting (or ignoring) their goals and expectations. To that end, data related to churn can inform the sales prospecting and qualification process, allowing sales reps to focus their efforts on high-potential leads by deprioritizing those with increased risk of churn.

To make this distinction, all you need is to sift through CS churn data and identify the early churn indicators for your customer base. Fortunately, these are typically the same for most SaaS companies:

- Mismatched expectations. The client never wanted what your product can offer, but they wanted something similar / adjacent to it.

- Budget constraints. Financial issues can be detected very easily and early on – they’re particularly apparent when someone on your team is trying to upsell them and the client is not receptive to the price increase. During the pre-sale, you can easily tell when the budget is the issue because the prospect will be stingy and heavily scrutinize the price.

- Product doesn’t help any outcome. Sometimes, a customer may come in not fully understanding why they want your product, or imagining an ideal scenario where they would use it. However, if you know their desired outcomes and what your product can do, you can generally tell if it’ll be able to solve those outcomes or not.

- Company size mismatch. Not all SaaS tools are meant for giant teams, conversely not all of the high-end tools have pricing options for small teams. It’s always a tricky balance, and both CS and Sales should be aware of this mismatch before the customer’s CFO notices and decides to cancel.

- Lack of product fit / need. The product may not be a match for the customer for a variety of reasons – CSMs and Sales Reps need to be able to identify those and avoid a customer relationship that puts both companies in financial dire straits.

Finding the Right Qualifying Questions to Avoid Early Churn Indicators

Once you have your churn precursors, you can use them to develop specific questions to be posed in early sales calls to identify potential churn risks. Questions like:

- What challenges do you face that this product might solve?

- How do you measure success with similar products?

- How many users will you require in your account?

- What is your approximate budget for this initiative / department?

These questions and others specific to your business model, niche, and customer base will tell you which prospects will cancel if you sign them, which ones will be more trouble than they’re worth, and, on the flip side, which could work out well with the proper focus during onboarding. Referring to a well-structured sales call script can help ensure these qualifying questions are consistently and effectively integrated into your early-stage conversations, allowing reps to detect churn risks earlier and tailor onboarding accordingly.

Gathering Accurate Churn Data

Both the questions and the churn precursors you identify rely heavily on good churn data to work. Sales can typically obtain this data from the CS department, or through the customer success platform directly. Here are some other important things you can try:

> Integrating a CSP with a CRM for automated health scoring

A pro move is integrating the CSP within your CRM platform to streamline the pre-qualification process and pass on customer health scoring data. This provides real-time health score updates to help sales teams prioritize efficiently and cut down the time necessary for data dissemination.

> Following a predictive churn model to increase insights

Predictive churn modeling is one of the most powerful tools CS has at its disposal, if they have the time to set it up. It can basically set clear churn precursors by conducting a full churn analysis of the entire customer base, and then create a model based on that to predict when customers reach those early stages. If your CSMs have this model, simply looking at it can tell you a lot about how a typical customer journey looks like and what Sales can be on the lookout for during prospecting and qualification.

How Lead Segmentation Based on Churn Data Can Help

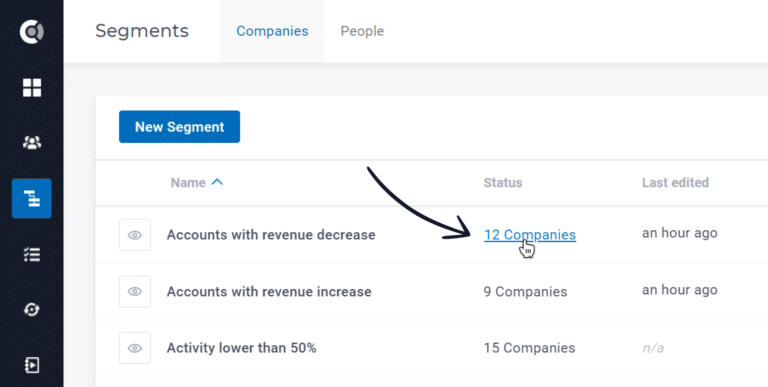

Churn data can also be used to segment your leads into specific groups based on any number of indicators recorded by your CSP.

To start:

- Obtain churn data from CS. The first essential step, as I already said. Many teams also enrich churn signals with external insight from B2B data providers, making segmentation and qualification far more accurate.

- Analyze churn data and draw conclusions / insights. Then, determine the early churn indicators and, of course, don’t forget to draw your own conclusions (sometimes another pair of eyes can be very useful when looking at customer data).

- Create a churn scoring system (if not already part of churn data). Once you have the metrics and know the churn indicators, simply create a scoring system for your leads and set strict rules for yourself to follow in presale conversations.

- Create a data-driven lead scoring system – create a formula including the churn score (but not 100% reliant on it) by leveraging churn-related data to create a sales-focused scoring system, weighing churn-related attributes such as industry, size, or engagement style)

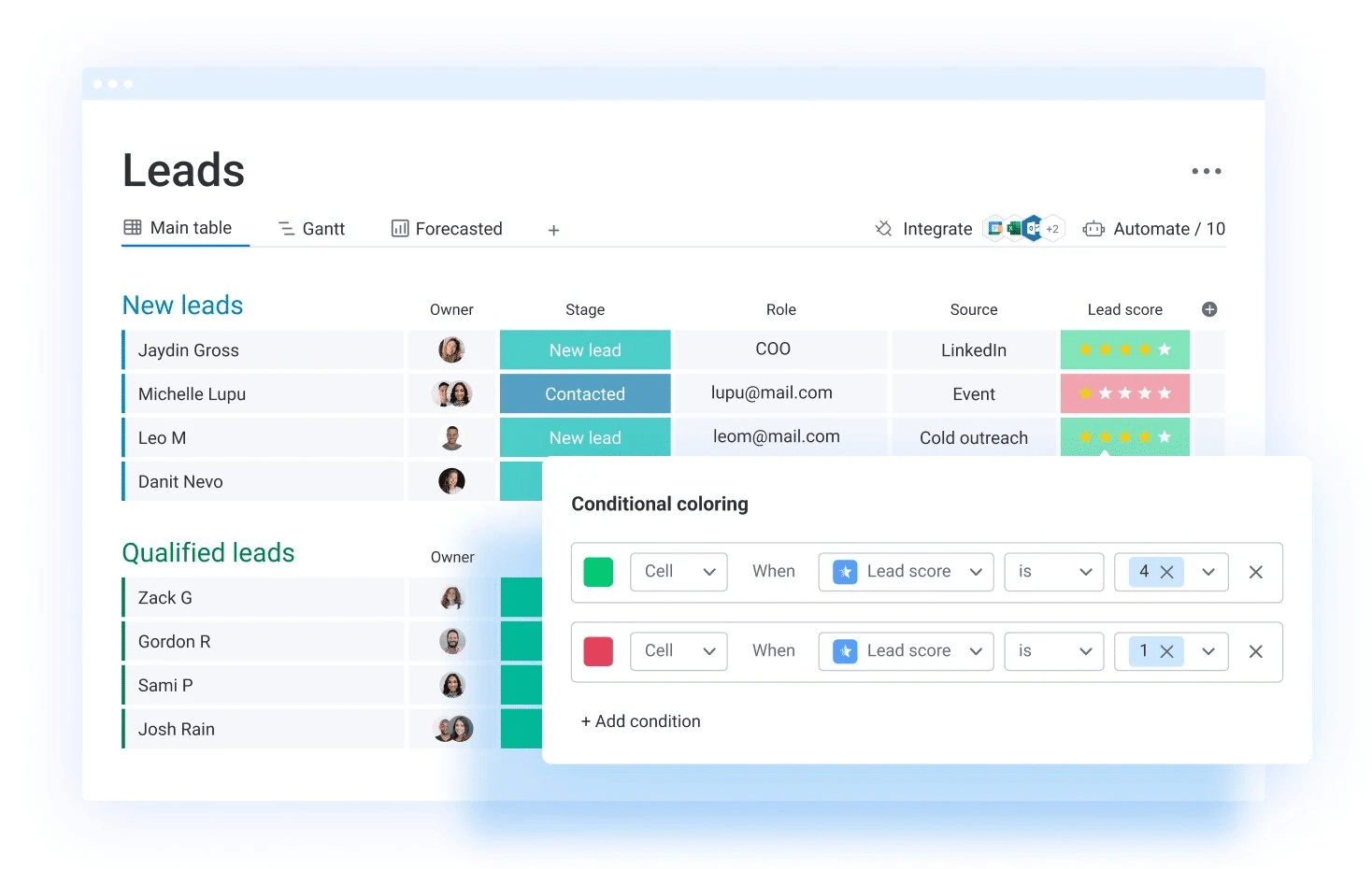

Source: Monday.com

Then, start making segments. Below, I’ve put together an extensive list of categories and actions you can use to segment your leads, complete with examples for each potential segment.

Note: the examples below may not apply to your particular product, niche, or target audience.

A. Based on Churn Score

1. High Churn Risk Leads

- Profile: high churn score leads similar to past customers who’ve churned

- Action Plan: use historical churn data to group and deprioritize prospects with similar profiles to customers who’ve churned

- Example: a small retail company that matches others who’ve usually churned in the past due to cash flow issues – can be deprioritized or moved to a self-service model

2. Median Churn Risk Leads

- Profile: medium churn score leads similar to past customers who were show middling churn indicators

- Action Plan: determine potential LTV, analyze leads, prioritize onboarding if high-potential, deprioritize if low potential

- Example: a software company that’s already changed the product they’re buying from you multiple times in the past. They may be difficult to convince, but not impossible.

3. Low Churn Risk Leads

- Profile: low churn score leads similar to customers who didn’t churn

- Action Plan: use historical churn data to group and prioritize prospects with similar profiles to long term customers

- Example: a healthcare company looking for a stable and long-term software solution like an emr for solo practice to adopt across their entire organization

B. Based on Value vs Churn Score

1. Low-LTV Leads

- Profile: high and medium churn score leads that are similar to past customers with low lifetime-value (LTV).

- Action Plan: determine potential LTV and lead score and deprioritize similar leads if low.

- Example: a local startup that only needs your low-cost subscription tier and has a history of changing solutions – they won’t grow and they won’t contribute a lot of revenue. However, if their support needs are minimal, it might make sense to still go forward with the lead.

2. Median-LTV Leads

- Profile: medium and low churn score leads that are similar to past customers with median lifetime value (LTV).

- Action Plan: determine if you can have a short payback period and / or high returns and balance, analyze, optimize onboarding, or deprioritize similar prospects.

- Example: a longtime software solution retailer that’s shown stable operations but overall middling growth and cash flow. They might be a good client with proper onboarding and optimized support costs.

3. High-LTV Leads

- Profile: low churn score leads that are similar to past customers with a high lifetime value (LTV).

- Action Plan: create a system to prioritize prospects who have similar traits to long-term, high-value customers – this is a future-proof tactic for business growth.

- Example: a multinational manufacturing corporation that requires a software solution to adopt across their global offices, with adequate onboarding and support for each adoption.

C. Based on Other Churn-related Data Points

1. At-Risk Companies

- Profile: medium and high churn score leads that are going through financial hardships

- Action Plan: deprioritize – sometimes churn precursors include signs that the company isn’t doing so well. A company that falls apart one month after they sign a high-ARR contract is far from a win for Sales and should be deprioritized even if their risk of churn isn’t that high by traditional signals

- Example: a mid-sized tech firm that fired their Lead CSM, had a 30% decline in earnings, or where you can see the company stock price plummeting. Such a situation might lead to a very intensive, high-touch, nerve-wracking, and ultimately fruitless onboarding process.

2. High-Potential Startups

- Profile: medium and low churn score leads that are showing good signs of growth, a good investment portfolio, or other signs of high potential

- Action Plan: create a system that doesn’t automatically deprioritize such prospects, but lets you analyze and decide on a case-by-case basis

- Example: a series-B SaaS with high ARR and a strong team, with a powerful champion for their customers’ success, but with a risky churn score. If they make it, you might land a great deal – and maybe it makes sense to help them as much as possible to promote mutual growth.

3. High Product-Fit Score

- Profile: medium and low churn score leads that show a great deal of synergy with your business, product, niche, and / or business model

- Action Plan: prioritize if churn score is low or lead score is high, aim to elevate the relationship into a partnership to drive growth for both parties

- Example: a small or medium fintech business looking for a highly-specific feature that your product already offers – in this case, your product would directly address their needs. It makes sense to prioritize such a lead, provided their other indicators aren’t too out there.

Steps for Churn-aware Sales Prospecting for Sales Teams

Now you’ve learned how to segment your leads, but how do you actually ensure you use your churn data for the next steps?

1. Prioritize Based on Segments and Churn Data

The first step to effective churn-based prospecting and qualification is to sift through sales data and create segments based on it, similarly to how I broke the process down in the previous sections. To recap:

- Get churn data from CS and your customer success platform.

- Review the data you gathered, gain insights and draw conclusions. Don’t forget that your CS colleagues might already have some of their own insights – it’s best to write your own and compare notes.

- Create a churn scoring system. CS may already have their own system – you can use that one.

- Create or update your lead scoring system. Based on that score, create or update your lead scoring system so it accounts for churn data.

- Create lead segments based on churn data. You can divide your prospects by churn likelihood, potential value, and other factors like product fit, company health, and so on.

2. Tailor Outreach Strategies for Each Segment

So you’ve carefully qualified your leads, now it’s time for the real work to start. Go through your history with each type of lead and pick out your most successful tactics. Based on those, create playbooks and scripts for each segment based on your preferred outreach methods.

For example, for prospects that match customer profiles with a median churn risk, consider writing down FAQs related to common churn precursors for those customers. That way, you can proactively address future points of contention from the start, lowering the risk of churn and helping CS at the same time.

3. Craft Highly-Specific Sales Pitches for Each Segment

Once you have your outreach strategies in place, it’s time to write some sales pitch templates for each one. Consider each segment’s particular wants and needs and how you can meet or exceed their expectations:

- For low churn risk leads, focus on long term value your solution can bring, along with scalability and more advanced features.

For medium churn risk, maybe shift the spotlight on the immediate benefits your product offers, along with how efficient and easy the onboarding can be. - Sometimes, you have to risk sending a message to high churn risk leads, in that case, maybe scrap all your playbooks and focus on their case, their pain points, and how you can adapt to their demands – that might just turn high-risk leads into real long-term customers (just don’t forget your product / CSMs actually have to be able to deliver on those promises).

- You can also craft multiple pitches for each segment. For example, say medium churn risk leads are easy to move through the pipeline but hard to convert – in that case, craft specific pitches for the late-stages so you can actually close the deals.

Overall, keep laser-focused on the value you can add, and you’ll have a clear path to closing most SQLs.

4. Track Conversion Rates and other Metrics by Segment

You can then track your success by measuring your usual sales metrics for each segment. Think things like:

- Conversion rate by lead and segment

- Lead-to-opportunity ratio for each segment and overall

- Opportunity-to-deal ratio for each segment and overall

- Demo-to-deal ratio for each segment and overall

- The average length of the sales cycle by segment (very helpful)

- CAC for each lead, segment, and overall

- Average MRR for each segment

- Early stage churn rate and number of churned accounts

- Deals lost per segment

5. Refine Prospecting and Reachout Strategies

Once you’ve been at this for enough time to be able to draw some conclusions, sit down and look at your performance post-churn-data-integration. You need to determine areas of improvement and constantly update your methods to keep with the times and with your prospects.

- Find sales bottlenecks – some leads are easier to convert than others, some stages of the pipeline go more smoothly while others like follow-ups drag the entire process. So look at each segment, write these down, and see how you can fix each bottleneck.

- Update your lead scoring and craft new segments – after these initial reach-outs based on churn data, you may find some leads are faster through the pipeline and close in record time compared to others. You can then reprioritize and create a separate segment with lookalike leads.

- Update sales collateral – once you’ve got the data, sync with marketing and update your collateral. You can even loop CS into the process to improve collaboration.

6. Leveraging Customer Success Data for Smarter Sales Prospecting

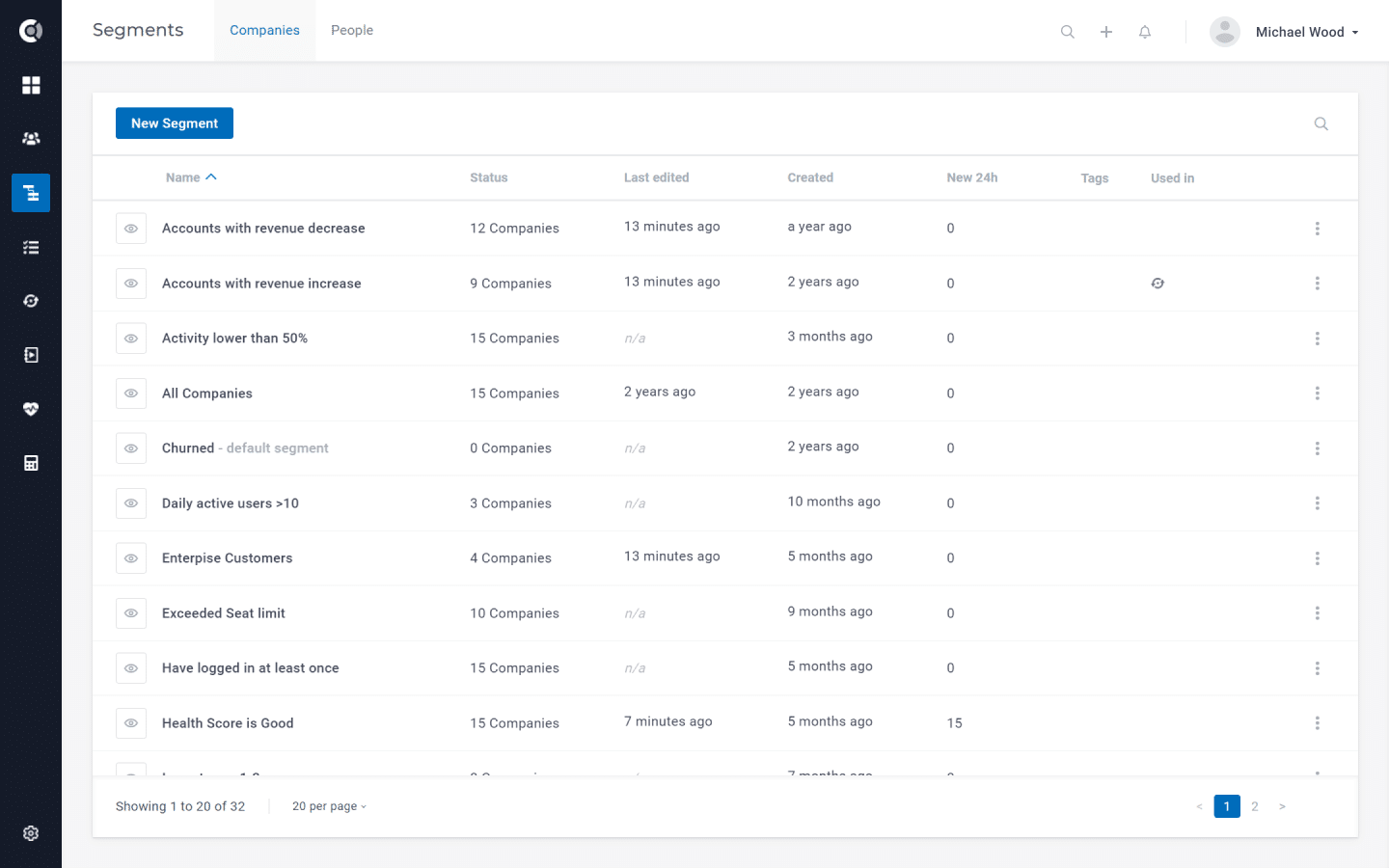

Integrating churn data into sales prospecting requires a streamlined approach to effectively organize, analyze, and act on the insights. With the right customer success platform, like Custify, sales teams can align with CS data seamlessly, enhancing the qualification and prioritization of leads.

Creating Dynamic Prospect Lists with Integrated Data

Custify enables real-time data synchronization between your CRM and customer success platform, making it easier to build and update prospect lists based on key churn indicators. This dynamic integration allows you to prioritize leads with a high likelihood of success and deprioritize those showing risk factors early.

Advanced Lead Scoring for Targeted Outreach

Leverage data-driven health scores and engagement insights from Custify to create custom lead scoring systems. Identify high-value leads with lower churn risks and focus your outreach strategies accordingly. This precise targeting boosts conversion rates while reducing the risk of onboarding poorly fit customers.

Stay Organized Across the Sales Pipeline

With Custify’s comprehensive dashboards and automated alerts, you can track sales interactions, account health changes, and prospect behavior in real time. This level of visibility ensures you stay organized throughout the sales pipeline, making informed, data-backed decisions every step of the way.

7. Leveraging the Right Tools for Churn-Aware Sales Prospecting and CRM Management

Utilizing key sales prospecting and CRM tools that integrate with customer success platforms can significantly enhance churn-aware prospecting. Here’s a curated list of tools to consider:

- Salesforce: A powerful CRM with extensive customization, automation capabilities, and integration options to sync customer health scoring data for tailored sales strategies.

- Custify: Purpose-built for customer success, Custify integrates with CRMs to deliver churn insights, predictive health scores, and comprehensive customer data, helping sales prioritize and personalize their outreach.

- Outreach.io: Streamlines automated, personalized prospecting workflows, allowing sales teams to craft data-driven communication strategies based on customer fit and behavior.

- Zoho CRM: An adaptable CRM solution that integrates easily with customer success tools to unify sales, marketing, and support data for effective lead prioritization.

- Pipedrive: A sales-focused CRM that allows for pipeline management and automation, with integration options to pull in churn-related data from customer success solutions.

- Close CRM: Offers robust communication tracking, automation, and streamlined lead management to optimize the sales process with churn insights.

By leveraging these tools in combination with customer success insights, sales teams can more accurately qualify leads, predict churn potential, and craft data-informed strategies to retain high-value customers.

Promoting Collaboration through Sales-CS Alignment

The entire process of using churn data in the sales process improves cross-departmental collaboration and alignment on customer outcomes.

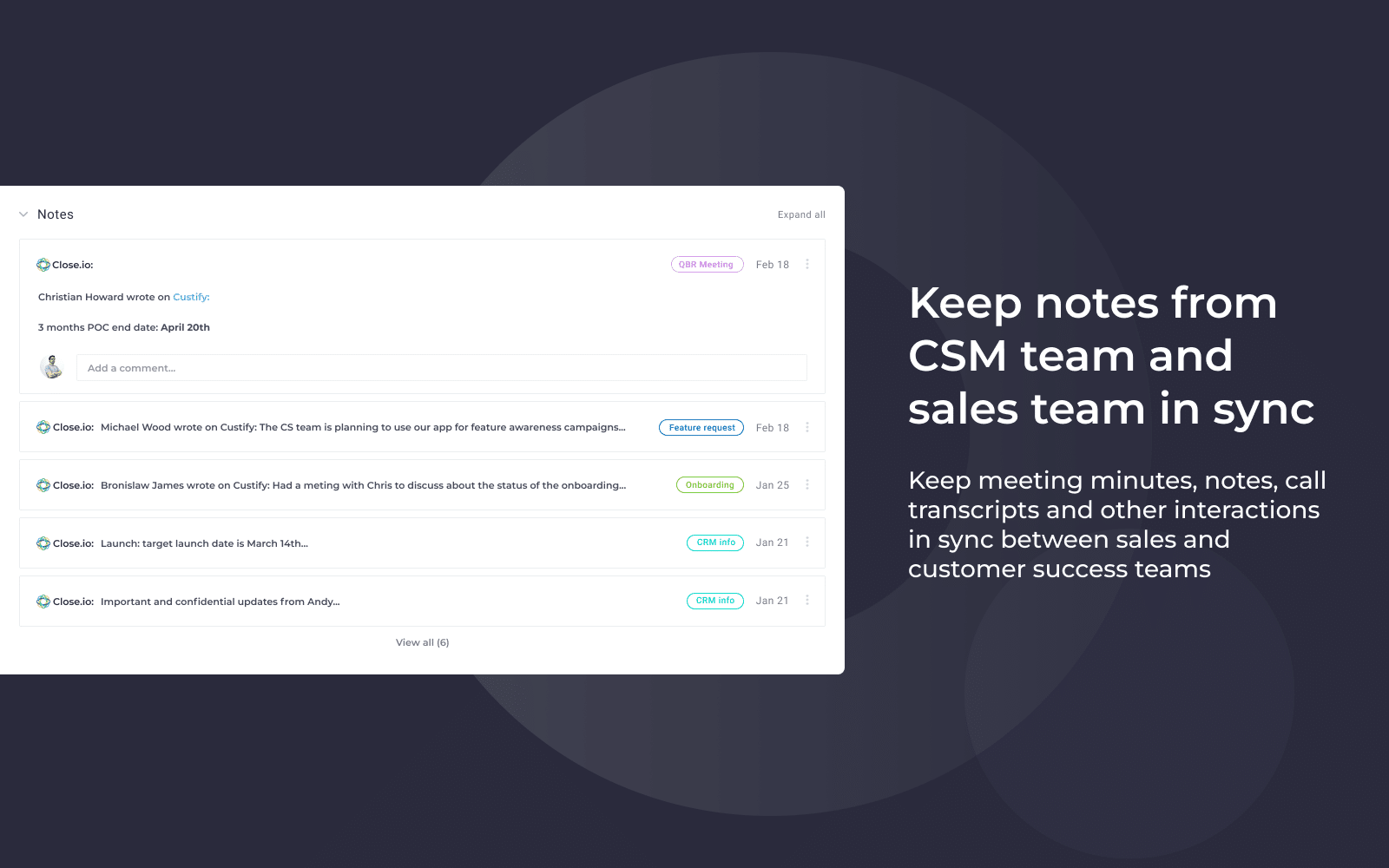

- Sales and Customer Success team collaboration. Encouraging sales and customer success teams to work together, share churn insights, and create best practices improves the overall efficiency of the organization and may eliminate points of friction between the two teams.

- Making the Sales Handoff more efficient. One point of contention between the two aforementioned teams is the handoff – i.e. when a deal goes through and the salesperson in charge needs to pass over the account details to CS. By working together before the sales even happens, this handoff can be smoother and more relevant to what CSMs need.

- Feedback Loops. Another way the process helps is by establishing feedback loops between sales and CS teams to continually improve lead qualification and prospecting efforts based on churn data. When efficiency becomes the norm, not the exception, you know you’re on the right path.

Conclusion: Better Qualification Through Churn Insights

So there you have it – a complete breakdown on how you can improve your sales prospecting and qualification by collaborating with customer success and synchronizing on churn data.

The relationship between CS and Sales is often fraught with conflict, so I hope that through my short model of collaboration you’ve learned to make it less of a blocker and more of a driver of growth – enabling the company to reach new heights of efficiency and cross-functional alignment.